Going Back to the Old Days?

Warsh and War Bonds

(For the best visualization, read on the website here.)

The Two Kevins

I was excited to try something different for today’s post. I had planned to concoct a fictional conversation taking place in June of 2026 between Secretary of the Treasury Scott Bessent and Trump’s choice for Fed Chairman, yes-man Kevin Hassett.

Alas, events have shuttered my quixotic desire to write fiction. President Trump admitted last week he had not yet chosen Hassett. In fact, Trump hinted that investor, academic, and former Federal Reserve Governor Kevin Warsh may be the new favorite.

It is the battle of the two Kevins! Since Warsh is the new frontrunner, this post examines what his appointment might mean for the markets and our portfolios.

The Old Days

While many discount the President’s words because of his penchant for hyperbole, I think it is safe to say that, above all, he wants strong economic growth. This clip from last week makes that quite clear:

These are the President’s precise words:

“We are going to go back to the old days…when we announce great results, we are not going to raise interest rates and kill it, it means that instread of 4% GDP or 3%, it should be able to be 20 or 25%. I don’t know why it can’t be.”

Trump was born in 1946 and graduated from the University of Pennsylvania in 1968. It is probably a fair guess that the “old days” are a period between these two dates. What was monetary policy back then?

There were two distinct regimes.

In 1942, to finance the costs of World War II, the Fed agreed to a radical form of monetary policy known as “Yield Curve Control” (YCC). Specifically, the Fed purchased government bills and bonds directly from the Treasury, keeping short-term interest rates pegged artificially at 3/8% and long-term rates at 2.5%. The Treasury also financed itself through the sale of “War Bonds.” The populace bought these bonds as a sign of patriotism, although the manipulated interest rates were a form of financial repression that guaranteed unwitting Americans a loss of purchasing power.

The posters hawking the war bonds were works of art:

Although World War II ended in 1945 and inflation rose to 14% in 1947, the marriage of the Fed and the Treasury continued until 1951. The advent of the Korean War drove inflation up to 21% in 1951, which enabled the Fed to convince the Truman administration to finally sanction a divorce from Treasury.

This is the elegant and concise one-sentence agreement the two bodies came to, an accord that established the Fed's Independence from the Treasury until 2008:

The Treasury and the Federal Reserve System have reached full accord with respect to debt-management and monetary policies to be pursued in furthering their common purpose to assure the successful financing of the Government’s requirements and, at the same time, to minimize monetization of the public debt.When Trump pines for the “old days,” I think it is fair to guess that he is referring to the first period, that time of ultra-low interest rates and patriots buying war bonds, and not the subsequent period of Fed independence.

True Believer or Trump Believer

The separation of the Fed and the Treasury lasted until the Great Financial Crisis (GFC) prompted the Fed to again purchase bonds from the Treasury. This program was called “Quantitative Easing” (QE).

Kevin Warsh was on the Fed Board at the time, and he initially supported QE.

As he explains in this May interview, the GFC represented an existential risk to the global economy in the way World War II represented an existential risk to global stability.

But Warsh believes that QE should have ended as soon as the GFC did, instead of lasting into this decade. Interestingly, he cites the 1951 Fed/Treasury accord as the basis for his view.

Listen to his own words in these forty seconds:

Now the $1.8 trillion question (the size of the US annual deficit): If Trump commands an eventual Chairman Warsh to cut rates to 1% and buy bonds from the Treasury to suppress their yields, will Warsh swallow his principles and his pride and obey him? Will he be able to persuade the rest of the Federal Open Market Committee to support him and the White House?

We discussed Treasury Scott Bessent’s swelling arrogance in last week’s feature post, “How Much Does Your Arm Weigh?” Bessent has almost certainly made a guarantee to Trump that Warsh, like Hassett, will be a team player. Otherwise, how would Warsh’s name have come back into play at the last minute? And would Warsh, having seen Trump’s public excoriations, shaming, and bullying of current Fed Chairman Jerome Powell, be willing to subject himself to the same humiliation?

It is the wolf of wall street’s view that both Kevins, Warsh and Hassett, will do Trump and Bessent’s bidding. That doesn’t mean such bidding will be forthcoming. We have seen the President retreat (TACO) from hardline positions in the past, and Trump may switch gears from prioritizing growth to prioritizing affordability as the midterms approach. That, though, is the subject for another post.

Markets don’t wait for outcomes. They price their probabilities today. The meteoric performance of gold and the weakness in the US dollar are “debasement” trends established long before Warsh’s emergence as favorite, and his appointment will do nothing to reverse them.

Repression Protection

This discussion reinforces the mantra of Asset Allocation we have repeated ad nauseam this year: diversification does not mean owning a mix of US Stocks and US bonds. It means owning a mix of asset classes denominated in different currencies.

The possibility of financial repression is real; if our portfolios are not prepared for it, then our wealth will evaporate with every monthly inflation reading.

That’s what happened to Americans during and after World War II. Those were the “old days” that President Trump remembers so fondly.

The Bright Side

To conclude this rather somber post, let’s look at the brighter side of nostalgia. Here is the 1974 hit from Chicago, which, of course, is called “Old Days.” The video includes the lyrics, and boy, do they paint a nice picture of the past.

Stop, click, and enjoy!

Bonus

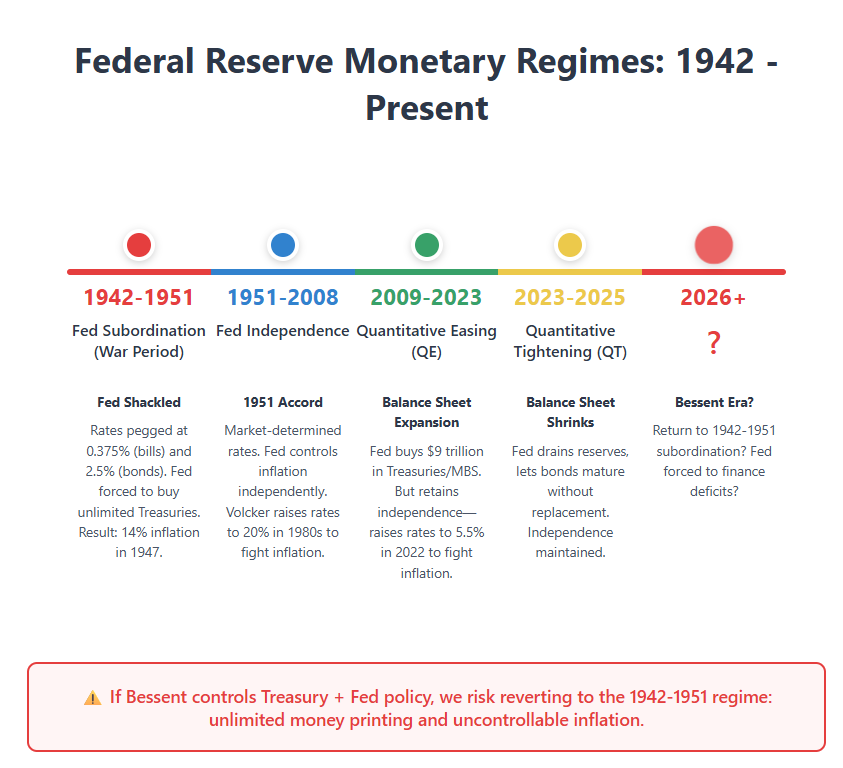

For monetary policy history buffs, here is a generally correct timeline of the monetary policy regimes discussed in this post. Graphics: Claude.