How Much Does Your Arm Weigh?

Bessent's True Colors

To read on the website, click here.

Last November, investors (including myself) celebrated the appointment of Scott Bessent as Trump’s Treasury Secretary. We devoted a post to the subject one year ago, almost to the day. Here is a print of the headline.

Markets had feared Trump might stack his cabinet with unqualified lackeys. Bessent was different. He had been a protege of the legendary George Soros and had built a successful hedge fund. It made sense that Wall Street would adore him. I did.

The post today explains how I was wrong.

Franklin the Turtle

On Friday, Bessent published this meme on X.

I asked around, and no one seemed to know what it meant. I certainly didn’t have a clue. I do know that the country has a fiscal deficit of 7% of GDP, and if Secretary Bessent is depending on Franklin the Turtle to finance us, we are in dire straits.

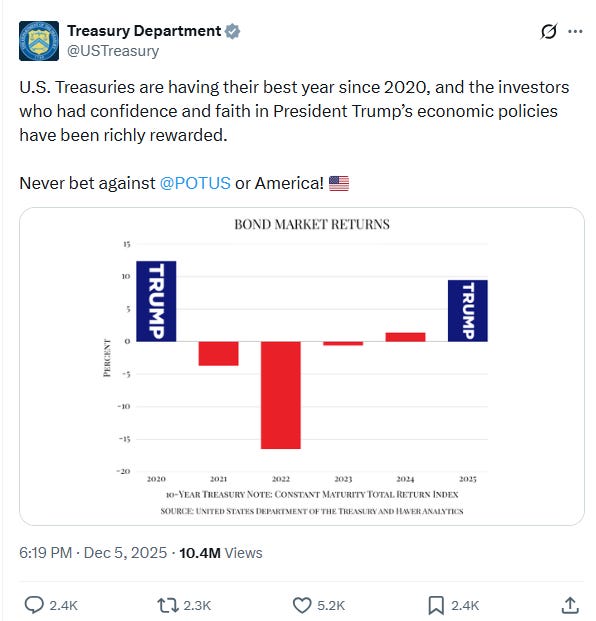

Bessent’s post followed a malevolently misleading post from the Treasury Department itself.

I won’t insult your intelligence, dear Reader, like Bessent does, by reminding you that lower interest rates and strong bond market performance are signs of economic weakness and even distress. You already know that.

In 2008, the worst year of the Great Financial Crisis, 10-year Treasuries returned 20%!

The Secretary left that part out.

The GENIUS Act

I began to lose confidence in Bessent over the summer, when the “GENIUS” Act was passed in Congress. The legislation provides a regulatory framework for “stablecoins.”

Simply put, a stablecoin is a digital “token” that costs one dollar and is collateralized by one dollar's worth of Treasury Bills. The law prohibits issuers from paying holders any interest on the stablecoins, making them a curious investment. That hasn’t curtailed their success - they trade digitally in the billions of dollars daily, mostly to settle bitcoin and other cryptocurrency transactions.

Stablecoin’s proponents believe that eventually, most financial transactions (buying merchandise, settling a stock purchase, everything) will occur with digital stablecoins. I hope this new technology is successful. Effecting a wire transfer is archaic and cumbersome.

This is how Secretary Bessent touted the bill in June:

Recent reporting projects that stablecoins could grow into a $3.7 trillion market by the end of the decade, [from $300 billion today]. That scenario becomes more likely with the passage of the “GENIUS” Act. A thriving stablecoin ecosystem will drive demand from the private sector for US Treasuries, which back stablecoins. This newfound demand could lower government borrowing costs and help rein in the national debt.What Secretary Bessent doesn’t explain is that even if the market for stablecoins were to grow to $3.7 trillion, there would be a negligible effect on the cost of government borrowing. That’s because someone who wants to buy a one-dollar stablecoin must sell something else he owns that is worth a dollar. That something else comes from his or her savings, which, by and large, is invested in a money market fund or bank deposit (CD).

The money market fund or the depositary institution sells what? A Treasury Bill.

The stablecoin issuer buys what? A Treasury Bill.

The net effect on demand is zero.*

Uh-oh, looks like we are going to need the Turtle after all!

Despite this outlandish claim, I gave Bessent more time to prove his colors. Unfortunately, instead of growing into his job, his job has grown into him.

In old-fashioned boomer parlance, he has gotten too big for his britches.

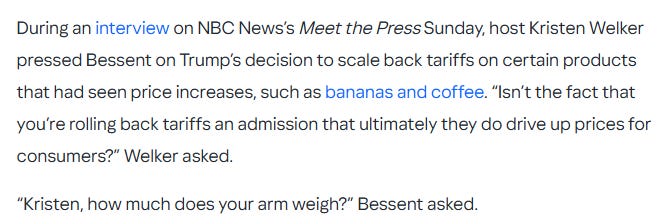

How Much Does Your Arm Weigh?

Consider his newfound arrogance.

Judge for yourself here.

The coup de grâce for me came Sunday, when I saw this clip in which Bessent ridicules and rips not only the directors of the Federal Reserve, but the staff.

Watch these 30 seconds for yourself and let me know if you think Bessent’s haughty hubris is healthy.

Bessent has shown me his true colors. He is a chameleon who has adopted his boss’s megalomania, manners, and meanness.

Next Week: Part II of the Bessent Lesson

President Trump will almost certainly name his Director of the National Economic Council, Kevin Hassett, as the next Fed Chairman. Hassett, although a qualified economist, is also a fierce Trump loyalist who served in his first Administration.

With Trump’s encouragement, we are going to see something that the country has not seen since the 1940s: the de facto union of the Treasury Department and the Federal Reserve. Bessent, in addition to being Secretary of the Treasury and Acting Chief of the Internal Revenue Service, will effectively become Fed Chairman.

That will make him the second-most-powerful man in the United States.

Next week, in Part II of this Bessent Lesson, we will examine what the upcoming Fed-Treasury wedding might mean for the markets and the midterms.

Will Bessent run the economy hot?

Will Bessent run the economy cold?

These are questions that are weightier than your arm.

Please go to the website and leave a like if so inclined. Click here.

*A technical footnote to the section on stablecoins: The only genuine source of new Treasury demand would come from digitizing the estimated $1.2 trillion in physical U.S. dollars held overseas. Even optimistically assuming 20% of that converts to stablecoins over the next decade, that’s only $240 billion in new demand—not the $3.7 trillion Bessent implies.

Great piece, David. I've thought the exact same thing for months, but you articulated it perfectly. As a veteran trader, you'd think he'd have more respect for markets. I fear the long end's going to teach him this lesson sooner rather than later.