Revolutions

Wall Street has investors going around in circles

My favorite movie about the financial business is Martin Scorsese’s “The Wolf of Wall Street.” I liked it so much that I named this newsletter after it.

In the opening scene, Matthew McConaughey, the malevolent Wall Street veteran, teaches Leonardo DiCaprio, the naive rookie, the secret of success.

Listen to these immortal fifty-eight seconds.

McConaughey is right - every decade sees a revolution, and with every revolution, Wall Street fleeces investors in the same way. A convincing narrative - a “revolution” as such - sends investors into a buying frenzy, and that frenzy creates the Fear of Missing Out (read about “FOMO” here), and assets become priced at implausible valuations. Then, even when the narrative actually proves to be revolutionary, the investor gets burned. The financial boom becomes a bust.

The comparisons of today’s AI revolution to the 1990s dot-com revolution are flawed. Cisco Systems was everybody’s darling (nod to Lou Reed) as Nvidia is today. The difference: in 1999, the market capitalization of Cisco was $450 billion on earnings of $2 billion; today, the market cap of Nvidia is $4.3 trillion on earnings of $100 billion. In other words, the price/earnings ratio of Cisco was 225x in 1999, and Nvidia is 43x today.

Of course, the internet has been a transformative technological and social revolution. The narrative was correct. The stock market punters weren’t. Cisco’s stock price fell 90% from its peak.

Doesn’t it make more sense to compare the AI revolution to the “Shale Revolution” of the 2010s?

Both AI and shale “fracking” were technologies initiated long before their respective booms. The term “Artificial Intelligence was first coined in 1956, and hydraulic fracking was first commercialized in 1949.

Fracking gained momentum in the early 2000s, and by the early 2010s, it was hailed as a revolution. Here are two illustrative headlines that whetted investors’ appetites.

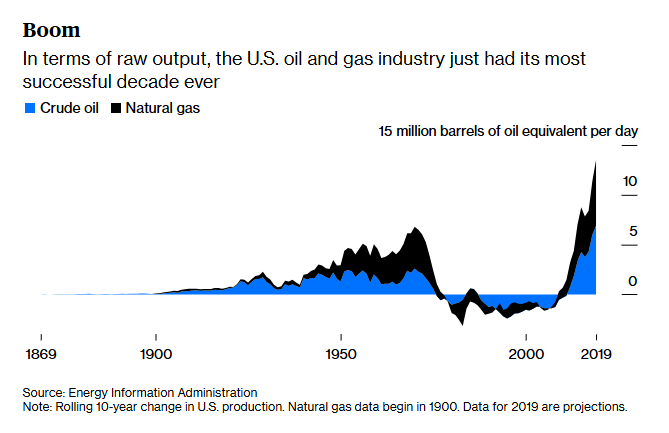

Was the optimism justified? Yes, yes, yes. Production went to the moon.

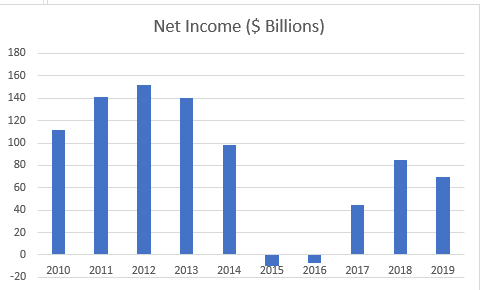

Like Nvidia, the oil companies entered their boom years with strong earnings and strong balance sheets. Then what happened? The law of unintended consequences set in. The oil companies overinvested, overborrowed, overdrilled, and underestimated the geological limitations of the Permian Basin and other massive shale regions. Then the price of oil tanked.

Net income tanked, too.

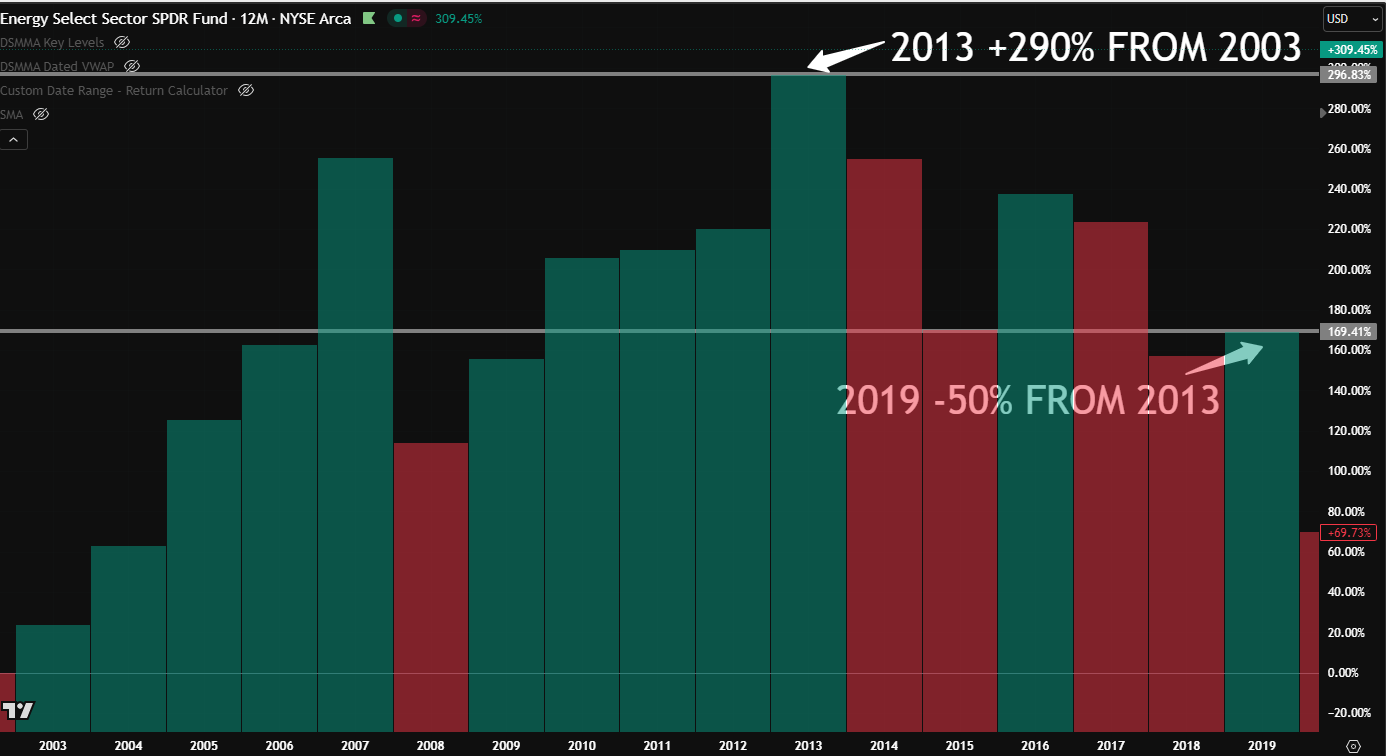

Meanwhile, back on Wall Street, this is what the price of the US Energy ETF XLE was doing, starting back in 2002. With a solid narrative and strong earnings, XLE rallied to its peak in 2013. Then, following the sinking earnings, the stocks collapsed.

ETF Share Price % Change from 2003.

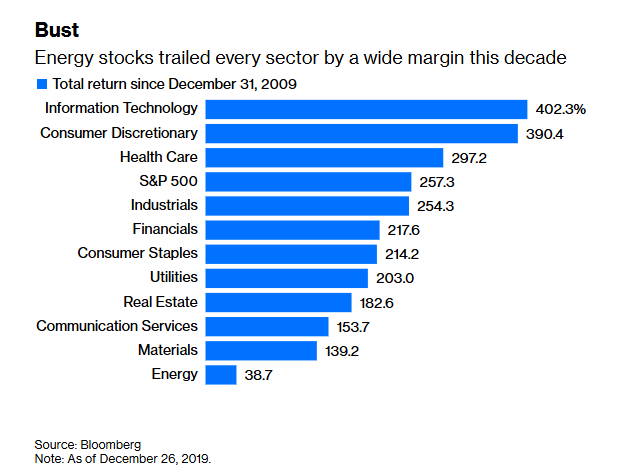

In fact, despite the hype, energy was the worst-performing sector of the stock market during the 2010s.

Fast forward to 2020, and, although the US had miraculously become the world’s number one oil and gas producer, the narrative on Wall Street went from hyper optimism to hyper pessimism.

Don’t get me wrong (nod to Chrissie Hynde), the Artificial Intelligence boom has more differences than similarities with the shale boom. But it has even fewer similarities and more differences with the dot.com boom.

This wolf of wall street does not deign to predict if and when AI stocks go from boom to bust. But if they do bust, like the energy companies of the 2010s, it will be because of overinvestment, too much leverage, and overcompetition. AI products could become commoditized. But be sure, Wall Street will have extracted its pound of investor flesh.

Considering this risk, how can you protect your portfolio?

The answer, my friend (nod to Bob Dylan), is in diversification. We have extensively written about diversification this year, especially in the post “Asset Allocation 101.” Diversification is not merely investing in different sectors of the stock market. It is investing across diverse asset classes, regions, and currencies, with each allocation based on rational position sizing.

Easier preached than practiced, but we will return to that topic before the end of the year.

Meanwhile, have a joyful Thanksgiving, and thank you, Dear Reader, for reading about revolution (nod to John Lennon).

Leave a like if you wish, by clicking here.

P.S. - Sorry for the “nod to’s” sprinkled throughout the text. Can’t help my rock and roll spirit.