Market Mulls Disruption, Lula Courts Corruption

Macro Monitor, February 16th, 2026

Last week

The primary stock indices fell 1.5%-2%, despite positive economic news that formerly would have been euphorically described as “Goldilocks”:

The January Employment Report was better than expected, with the unemployment rate falling a tick to 4.3% and 130,000 net jobs added.

January Consumer Price Index headline inflation came in at 2.4% and core at 2.5%, slightly cooler than market expectations.

The “vibe” from reading research reports and the financial media reflects an investor community mulling nervously about the potentially deleterious effects of Artificial Intelligence on existing industries.

The image that comes to mind is 22 players on a football pitch running to and fro because nobody knows the rules of the game.

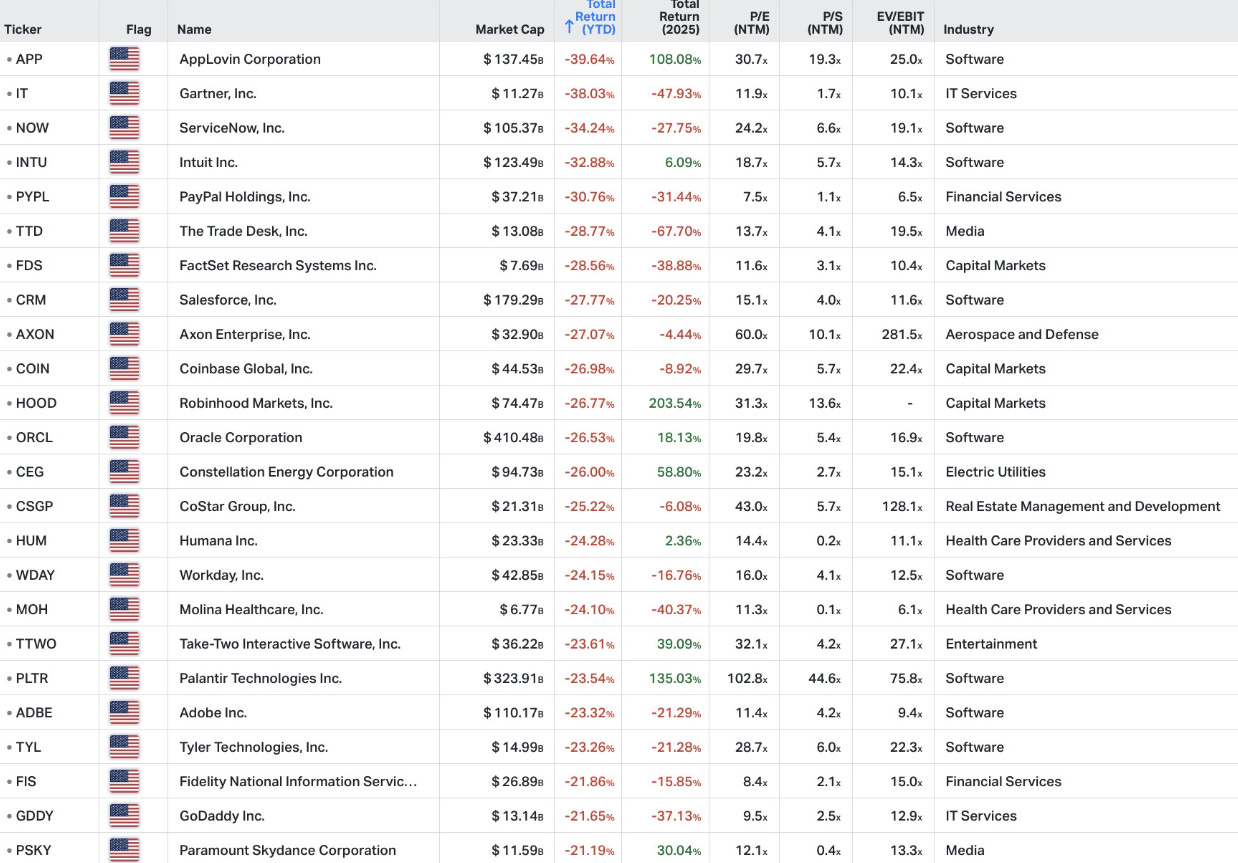

The worry has especially hit the software sector. Salesforce is -28% since the beginning of the year (which sounds like a long time, but has only been six weeks!) Also, since January 1: Intuit -33%, Oracle -36¨%, Workday- 24%, and Adobe -23%.

This table from Koyfin Charts shows the gory detail; note how software dominates the biggest S&P losers for the year.

Macro winds are swirling over the East, where Japanese Prime Minister Takaichi, the first female to hold that job, won an overwhelming landslide in Parliamentary elections. She will now have free rein to implement a fiscal expansion.

The markets are expecting repatriation of foreign investments back to Japan, a perception that appreciated the yen 3%, an outsized move that reinforces the importance that politics has gained in influencing economics.

An update on the energy sector, which we discussed at length in last week’s feature “Shifting Tech-tonics”: XLE, the US energy ETF with holdings that include oil producers and refiners, set a new all-time high, surpassing its previous May 2014 peak, brought on by the US shale revolution.

Interestingly, West Texas Intermediate Crude was trading around $125 a barrel in 2014, roughly twice its price today.

The coming week

The markets will react to a slew of economic releases, including: December Housing Starts and Durable Goods, January Industrial Production and Capacity Utilization, Weekly Unemployment Claims, and December New Home Sales.

On Friday, fourth quarter GDP will be released. The expectation is for 2.8% growth, down from 4.4% in the third quarter. December Personal Consumer Expenditures (PCE) will also hit the tape, with the expectation for the core reading (ex food and energy) at 3%, up from 2.8% in November. Remember, the PCE is the Fed’s preferred inflation metric. Many wonder why the Fed is lowering rates with inflation 1% above its 2% target.

On Tuesday, US envoys Jared Kushner and Steve Witkoff will meet with the Foreign Minister of Iran in Geneva, where they will attempt to negotiate a new military and commercial deal. The US is insisting that Iran give up not only its nuclear program, but also its long-range ballistic missile program. The former is possible; the latter seems a pipe dream.

Although oil traded lower last week, it is up 10% year-to-date, largely pricing in the possibility of armed conflict between the two countries. Last week, the US redeployed its largest aircraft carrier from Venezuelan duty in the Caribbean to the Middle East. Reuters reported that the Pentagon is preparing for the potential of a weeks-long campaign against Iran if negotiations don’t bring results.

Any type of agreement would provide a positive shock for the markets, whereas any breakdown in the talks will push oil even higher and add to the existing fragile macro backdrop.

On Friday, the Supreme Court is likely to hand down its long-awaited ruling on the legality of Trump’s tariffs. The market is prepared for the Court to rule against the Administration. What isn’t immediately clear is whether and how the Administration will react.

Brazil

Asset prices were largely unchanged on the week, with the currency at 5.22. The Banco Master scandal has not abated, and unusually good investigative reporting by the local media continues to reveal suspicious ties between the bankrupt bank and members of the Supreme Court. The Court has closed ranks to defend the integrity of each of its members, notwithstanding ample evidence of illegalities.

The markets are closed this week until Wednesday for the fabled Brazilian Carnaval (Portuguese spelling). What ought to be a celebration of culture turned into a political travesty. One of the traditional “schools” in Rio de Janeiro dedicated its parade to - guess who - President Luis Ignacio Lula de Silva, who partied in his VIP box until five o’clock in the morning.

There is a presidential election in October, and Brazilian law strictly prohibits early campaigning. Even more scandalous is that the Lula-loving parade was partially financed with federal money.

Attempts by the political opposition to sanction Lula in the Federal Electoral Tribunal have fallen on deaf ears.

With that, instead of an actual photo of beautiful samba dancing queens and a drum corps pulsating African rhythms, here is a caricature of President Lula, living it up at the expense of ordinary Brazilians, impotent to eliminate the scourge of political corruption.

I leave any parallels with what is happening in the United States for you, Dear Reader, to draw.

Important Publication Note

As an American-Brazilian, I was granted a double holiday this week - Carnaval and Presidents’ Day.

For this reason, there will be no weekly feature post. However, next week’s post will be extraordinarily ambitious - an attempt to shed light on the most important topic facing society today:

What are the economic, moral, philosophical, and market implications of AI mass adoption?

Don’t miss that feature next Tuesday.

Have a great week, as carefree as that of a dancing President Lula.

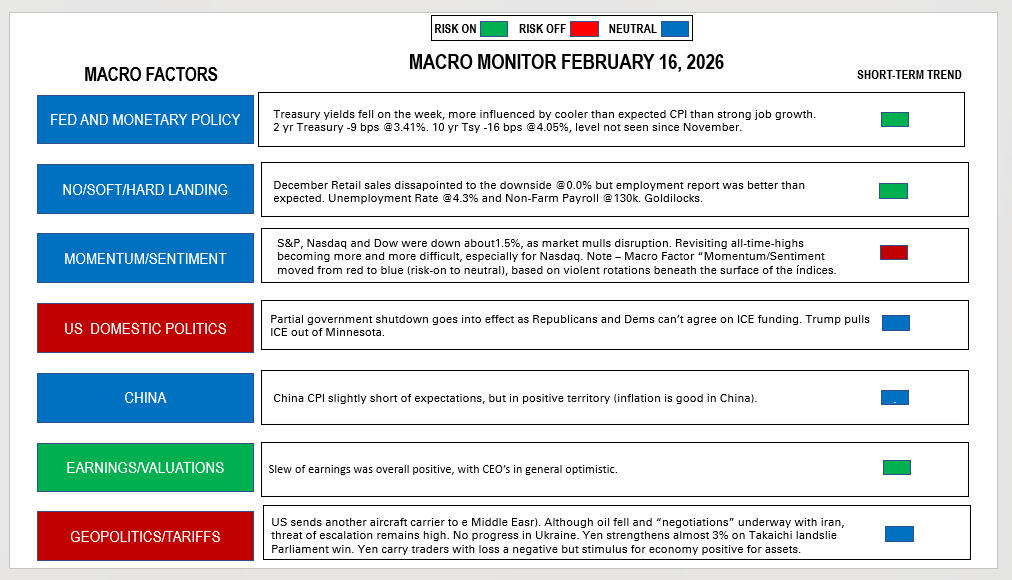

Macro Monitor

For the third straight week, the Monitor is flashing neutral, although the number of reds and greens is increasing.

It is important to note that although the market is mulling AI disruption, the model is not suggesting lower prices.

Thanks David! Definitely a busy week.

Looking forward to your next post! abraço.