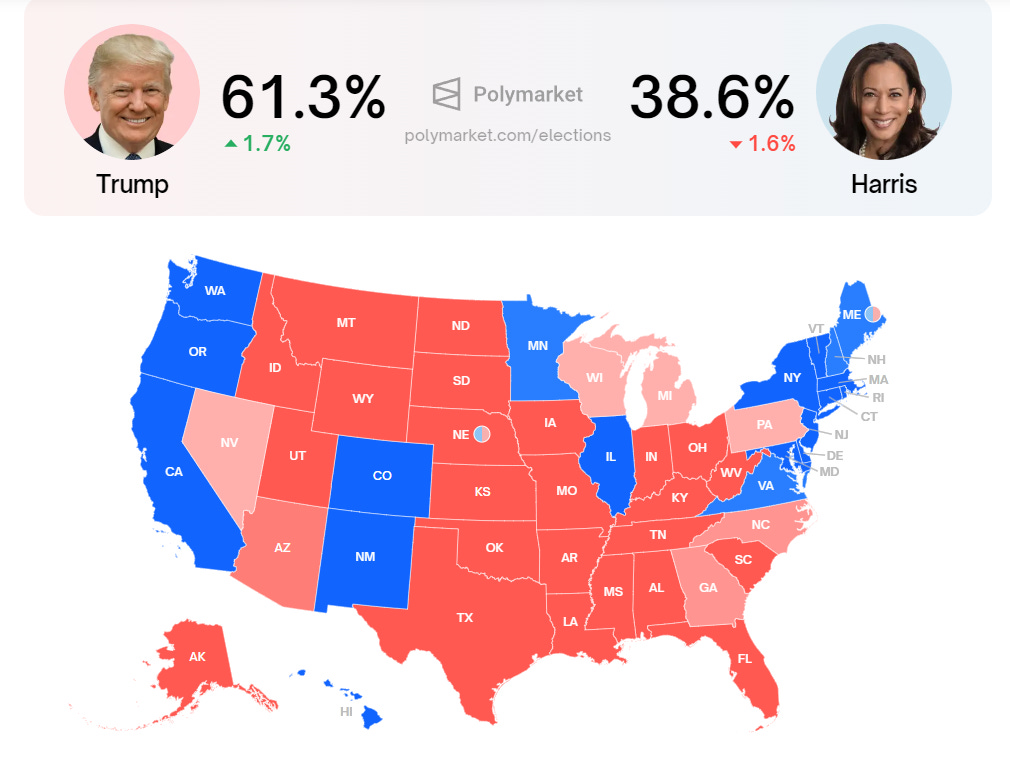

Betting markets have gone all-in on a Trump win. On betting site Polymarket, more than US$2 billion has been wagered. Here is the lastest snapshot.

Trump’s ascendancy has spilled over to make the Republicans even odds to win a majority in the House of Representatives. In mid-August, the bettors gave them just a 35% chance.

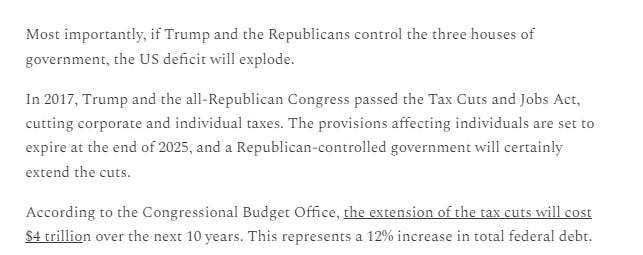

In my July 1 post, the wolf of wall street registered its concern with a possible “Republican sweep:”

At the time of the post, the US Treasury 10-year note was trading at 4.41%. When the Fed unexpectedly cut the overnight Fed Funds rate by 50 basis points in September, “Fed Fever” saw the ten-year note touch a low yield of 3.70%. Since then, coincident with Trump’s rise in the betting markets and, to a lesser extent, in the battleground state polls, the rate has risen almost in a straight line. We are now trading tens at 4.14%.

Now on to what is really bothering the Treasury market.

Last week, Trump delivered what perhaps has been the most memorable line of the campaign:

“The most beautiful word in the dictionary is “tariff.” Have a listen!

Trump does not need both Houses of Congress to make good on his threat to levy a 60% tariff on all Chinese goods nor a 10% across-the-board tariff on all imports to the US. He has the legal latitude to do that on his own.

Most observers doubt that his threats will become a reality. Their rationale is that Trump is simply anchoring eventual bilateral trade negotiations.

It is beyond this observer’s capacity to decipher ifTrump is merely blustering. However, I have seen credible estimates that partially implementing Trump tariffs could contribute 100 basis points to inflation.

In September, the Fed projected 2025 inflation at 2.20%. This estimate does not account for any possibility of tariffs - the Fed does not incorporate possible political outcomes into its models.

If inflation were to come in 1% higher because of tariffs, then the Fed would be prohibited from lowering its rate to 3.50%, as the market currently prices.

A tariff-infected inflation rate of 3.2% (2.20% + 1%) would imply a Fed Funds rate of around 4.20%, and a Fed Funds rate of 4.20% might mean a ten-year note rate of 5.60%, considering that the average spread between Fed Funds and ten-year yields since 1990 has been 140 basis points.

I don’t think that ten-year notes will be trading over 5% anytime soon, but from today’s 4.15% we could see them move toward 4.50%. Whether the Trump Treasury Tariff Tantrum moves to hurting stocks is a subject for future posts. Spoiler - tariffs could reduce GDP by 0.50%.

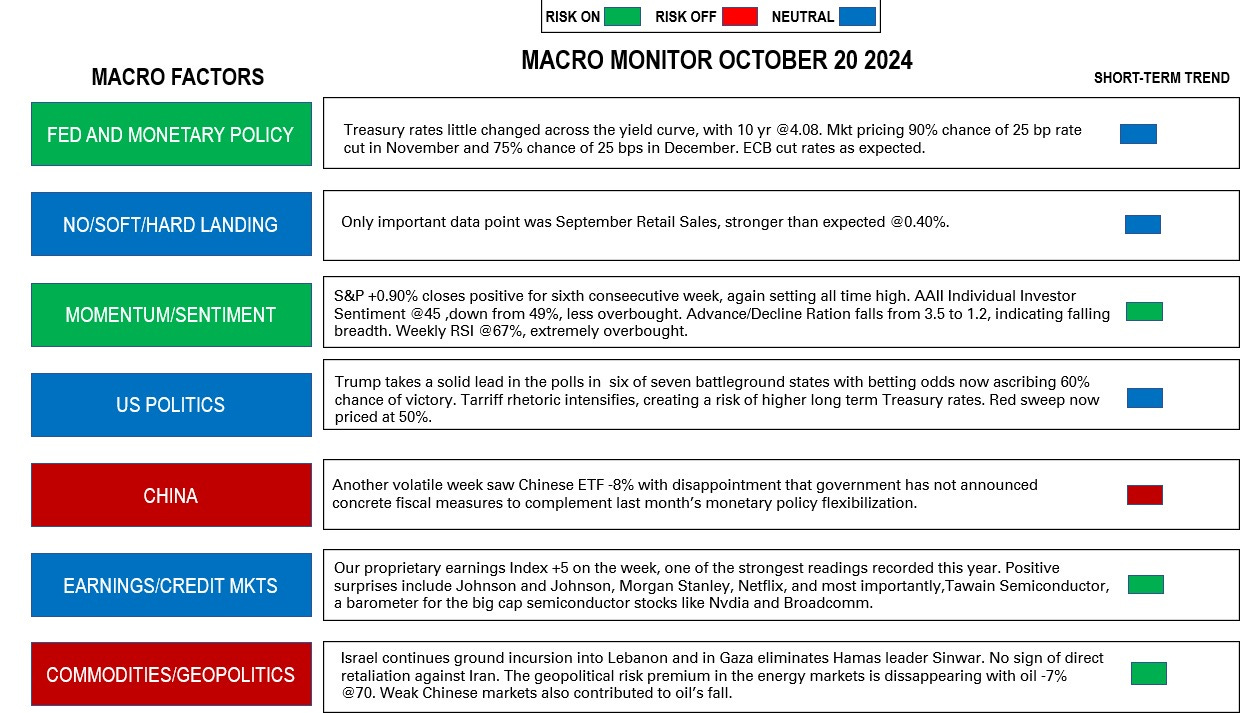

Last week, the Monitor notched another win, projecting “risk-on.” Corporate earnings came in better than expected and the S&P moved up for the sixth consecutive week.

This week, the Monitor is again flashing “risk-on” for the S&P, but it will be important to keep an eye on those rising Treasury yields.

Disclaimer: The content of this post reflects only the views of the author and not necessarily those of Armor Capital.