In our June 10th Post, “The Year of the Election,” we pointed out that elections in South Africa, India, France, and Mexico were having significant impact on the price of financial assets in each country.

Last week’s Biden/Trump debate officially kicked off the interplay between the US election and the markets.

We have studied the historical performance of stocks, bonds, and commodities in the first, second, third, and fourth years of both Biden’s presidency and Trump’s. The analysis drills down to consider the relative performance of sectors and even individual stocks.

Our highest conviction is that a Trump second term is inflationary, especially if the Republicans control the Senate and the House of Representatives.

Record immigration has been a key factor in balancing labor demand and the supply of workers. Were Trump to limit immigration significantly, and even succeed in his plan to expel undocumented workers, a smaller workforce would result in wage inflation.

If Trump were to succeed in increasing tariffs on China and other trade partners, a lower supply of goods would be inflationary.

If here were to replace Federal Reserve Chairman Jerome Powell, whose term ends in 2026, with a puppet who lowers interest rates prematurely, inflation expectations and inflation itself will rise.

Most importantly, if Trump and the Republicans control the three houses of government, the US deficit will explode.

In 2017, Trump and the all-Republican Congress passed the Tax Cuts and Jobs Act, cutting corporate and individual taxes. The provisions affecting individuals are set to expire at the end of 2025, and a Republican-controlled government will certainly extend the cuts.

According to the Congressional Budget Office, the extension of the tax cuts will cost $4 trillion over the next 10 years. This represents a 12% increase in total federal debt.

Last Thursday, the country saw a cognitively impaired President Joe Biden debate with ex-President Trump. Before the debate, the betting houses showed equal odds for Trump and Biden to win the November election.

After President Biden’s disastrous performance, those odds moved up to 60% for Trump, and down to 20% for Biden. Possible Biden substitutes like Gavin Newsom, Michelle Obama, and Gretchen Whitner, and third-party candidate Robert Kennedy Junior, make up the remaining 20%.

What did the bond market do on Friday? Here is the chart of the yield of the benchmark ten-year Treasury note:

Trump is bad for bonds.

Whether higher interest rates under a Trump presidency will be a headwind for the equities is less clear, but this wolf of Wall Street plans to update you weekly on the twists and turns of both the campaign and the markets.

Full disclosure: Some of the analysis in this article was influenced by the ideas of Former Secretary of Treasury Larry Summers, whose warning of the economic dangers of a Trump presidency is well summarized in this article from Market Watch.

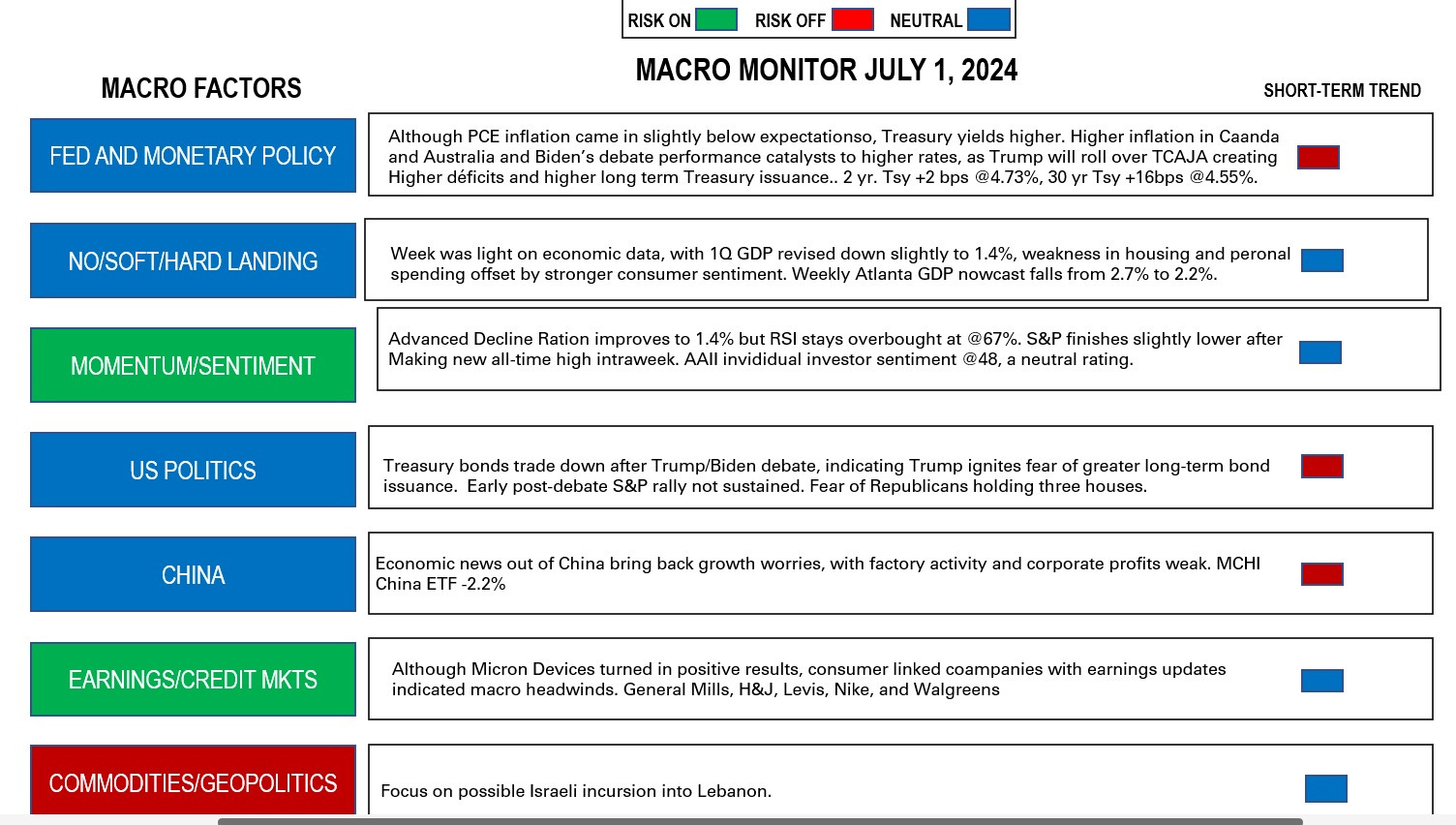

Higher interest rates last week resulted in the Macro Monitor moving from green to blue, that is, from risk-on to neutral for this week.

Disclaimer: The content of this post reflects only the views of the author and not necessarily those of Armor Capital.