I am writing on Easter afternoon, and a paella prepared by my wife of Spanish descent will beckon soon. Please forgive me for a shorter post than usual.

The narrative that dominates the markets now is one we have examined since the beginning of the year. Economics and the markets have uniquely been driven by politics. Politics has been uniquely driven by President Donald Trump. And the President has uniquely been driven by his supernatural sense of infallibility.

In our first post of the New Year, “Ladies and Gentlemen, Let’s Get Ready to Rumble” (read here), we wrote:

“High valuations, political volatility, fiscal vulnerability, and questionable productivity gains might override continued solid economic growth…Solid GDP and employment are no guarantee of a strong market, and the 20% plus returns of 2023 and 2024 for the US stock indices will be extremely difficult to repeat.”

That post captured the general direction markets have moved toward, but it fell short of foreshadowing the metaphysical metamorphosis they are struggling to price.

An 11%% sell-off in the S&P year to date has improved valuation of US stocks, but Price/Earnings ratio remains high at 20.5 (S&P Index weekly chart)

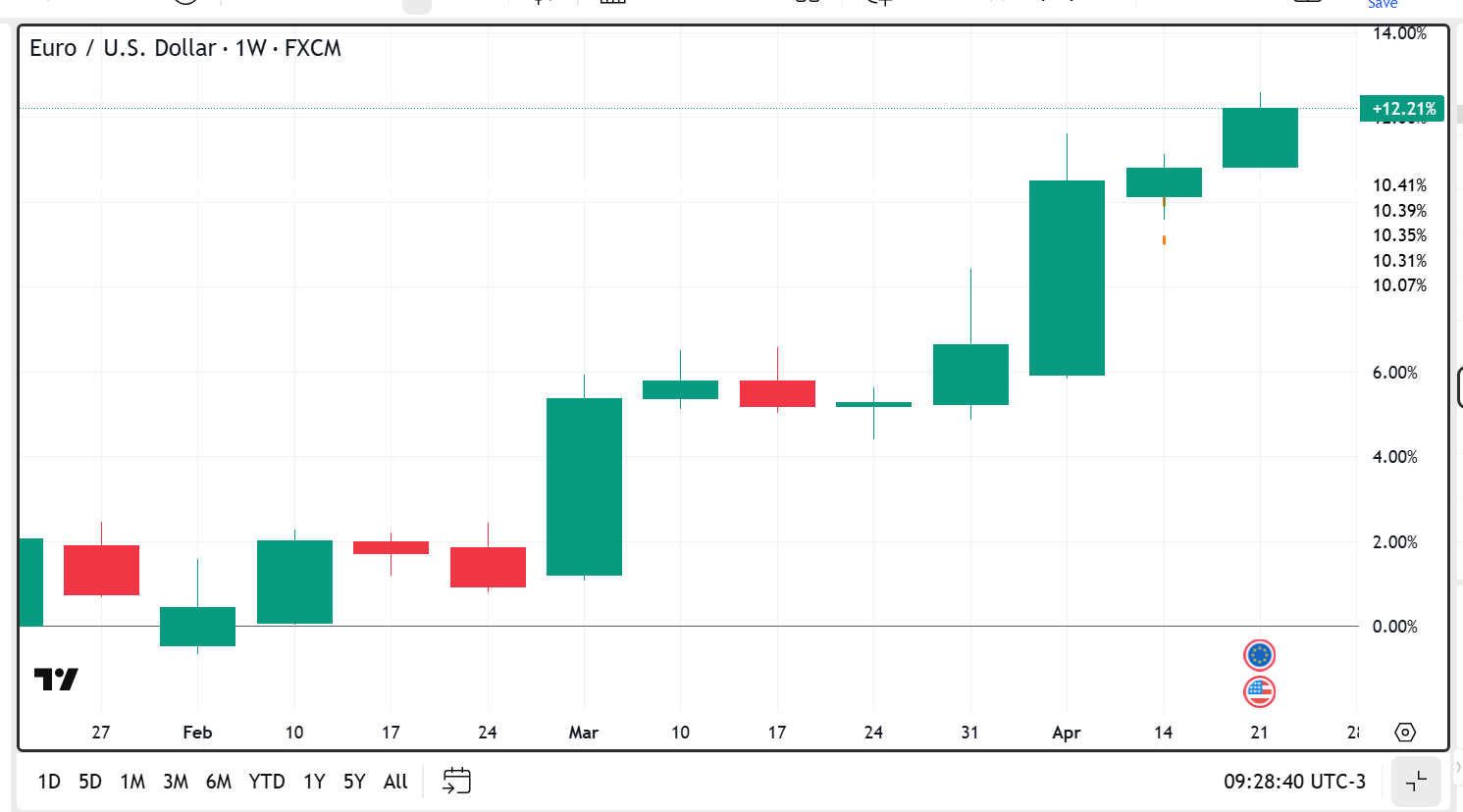

US politics, specifically Trump’s tariff bazooka, has gobsmacked the US dollar. The Euro is up 12% year to date (Euro/USD weekly chart)

US Treasuries have not worked as a safe haven, as fiscal concerns have kept US interest rates from falling (10-year Treasury yield, weekly chart)

China Tech has challenged US AI Exceptionalism, sending flows out of the US to China and other non-US markets. Weekly Chart, China Tech ETF (purple) +9% x Nvdia (red and green candles) -32%.

Since the wolf of wall street has been quoting himself too much, let’s instead quote the mainstream press:

These realized prognostications are now registered on the front pages of almost every publication in the Western (and Eastern!) world.

Our private narrative is now public!

When your private narrative becomes part of the public domain, then it is time to search for a new narrative. The “old” narrative has become imbibed into market prices, and markets feast ferociously on surprises and nibble meagerly at old news.

Which brings me to the subtitle of today’s post, which has completely unintentional but unmistakable religious overtones:

Is this the end, or just the beginning?

Are tariffs the alpha or the omega?

Will the Federal Reserve survive Trump’s threats to fire Jay Powell and remain a free spirit?

Will the once-holy trinity of the US Dollar, US Treasury Bonds, and US stock markets resurrect with new facts, and/or flows, and a new narrative?

One must have great faith to answer yes to that final question.

The paella is ready. Our Easter essay on Market Metaphysics ends here, but in summary, let’s remember what Winston Churchill said in 1942 about the status of the fight against Germany.

The Macro Monitor is, once again, indicating a risk-off environment for the week.

(Please leave a like!)

Disclaimer: The content of this post reflects only the views of the author and not necessarily those of Armor Capital.

Good luck to you and me.