Since mid-December, we have been barraged with prognostications for market performance in 2025.

While I would like to guide your investments by telling you what to buy and what to sell, and when to do it, I do not have the crystal ball some of these pundits profess to have.

What I do possess though is a degree of intellectual honesty and humility to keep my “advice” simple and limited to some guidance for you on HOW to think about the markets.

If you are a regular reader, you might also know of my love of linguistics. Unfortunately, contemporary English has been infected with many overused expressions that do not resonate well with me. I see them both in print and social media and hear them incessantly on talk shows and podcasts. To both have some fun and share my indignation, I will use several of these already hackneyed expressions in this post and highlight them in italics.

Along the way, I will use some expressions that are dear to my heart and will conclude like a linguistic heavyweight.

I had originally penciled in the subject for this post to be a deep dive into stock market valuations. Instead, I want to cover briefly several macro factors, including valuation, that are on my radar.

Valuation Uncertainty.

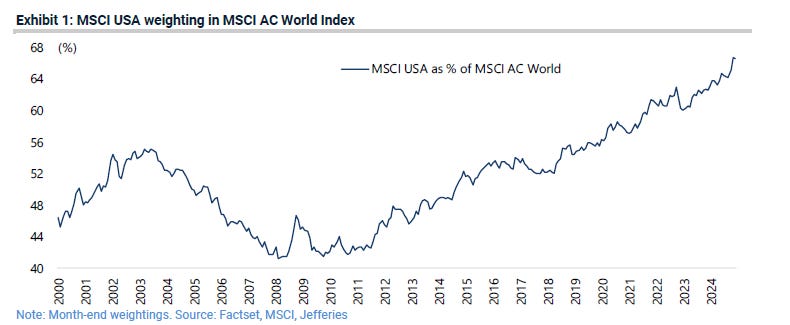

This is a conversation we need to have. The US stock market has outperformed world markets for decades. Look at this chart from the brokerage house Jeffries which shows the growth of the market capitalization of the US stock market as a percent of the value of world stock markets. This is what is now called American exceptionalism.

Not only has the US Market outperformed on a relative basis to other world markets, it has outperformed itself. That is worthy of a shout-out to famed futures trader Larry Williams. In his recent video wonderfully titled The Good, the Bad and the Ugly , he shares his view that the markets will benefit this year from sustained economic growth, but bear market storm clouds are brewing.

Remember this point about solid economic growth because I will circle back to it at the conclusion of this post.

Specifically, Williams looks at what we market geeks call the Cyclically Adjusted Price Earnings Ratio (CAPE ratio). This is also called the “Shiller Price/Earnings Ratio,” after its inventor, economist Robert Shiller.

Instead of considering one year of earnings like the traditional price/earnings ratio, the CAPE ratio uses the average of the last ten years of earnings, adjusted for inflation. This is a 30,000-foot view of equity market valuation.

The present CAPE ratio for the S&P is 38.5, 54% higher than its historical average of 25.6! Williams publishes the cautionary table below. It shows that when the CAPE ratio is well above its average, then the annual return of the S&P for the following ten years tends toward zero, with some periods seeing investors lose 6.1% a year. Scary stuff. Buyer beware.

Political Uncertainty

In just two weeks, Trump takes office and we do not yet know what his economic policy will look like. We know that “tariffs” is his favorite word, but how, when, and against whom he will roll them out is a mystery, and may continue to be a mystery after Inauguration. To use an expression I do like, investors are “flying blind.” Trump is mercurial and the market’s perception of economic policy will change from tweet to tweet (post to post).

Fiscal Uncertainty

Another question mark is whether Elon Musk and Vivek Ramaswamy will be successful in lopping off $2 trillion from total government spending over the next ten years. If they are successful, which is doubtful, that will be very, very positive for the US bond market. But success would mean that the fiscal impulse that has bolstered GDP since 2020 will wane, and that will be bad for stocks. To use an expression I love, “damned if you do, and damned if you don’t.”

Either way, how the US government refinances maturing debt will continue to be a source of volatility for both bonds and stocks and a subject for the wolf of wall street’s for the next 52 weeks.

Productivity Uncertainty

This is also the year when the markets will judge whether the billions being spent by the big tech companies on Artificial Intelligence can create marketable products with returns that justify these investments.

Kudos to Jeffries for this table showing the size of their MONTHLY capital expenditures:

Will the potential deflationary productivity gains of the AI revolution compensate for the potential inflationary shock of Trump tariffs? Or is Big Tech throwing good money after bad?

So there we have it:

High valuations, political volatility, fiscal vulnerability, and questionable productivity gains might override continued solid economic growth. And we didn’t even touch on geopolitics, where perhaps we finally get some good news and Trump helps end the war in Ukraine or bad news as the terrorists that have taken power in Syria help Iraq retaliate against Israel.

Now for my principal message, one that I hope keeps you out of trouble:

Solid GDP and employment are no guarantee of a strong market, and the 20% plus returns of 2023 and 2024 for the US stock indices will be extremely difficult to repeat.

A lot can go wrong this year, and the almost certain volatility will mean that investors should remember, as reggae man Jimmy Cliff immortally put it, the “harder they come, the harder they fall,” an adaptation of the expression that originated in boxing in 1900: “the bigger they are, the harder they fall.”

In fact, the sport of boxing has given birth to a veritable legion of expressions that we joyfully use in day-to-day conversation, and that we can apply as a conclusion to our modest advice to you, dear investor, for 2025:

No need to throw in the towel on your US big cap portfolios, but remember to roll with the punches, stay off the ropes, and most importantly, keep your ringside seat to all of this by continuing to read the wolf of wall street weekly.

Ladies and Gentlemen, let’s get ready to rumble!

Perhaps it is no coincidence that this week, the Monitor is flashing blue - NEUTRAL!

Disclaimer: The content of this post reflects only the views of the author and not necessarily those of Armor Capital.