Just My Imagination?

The (Rise and) Fall of Interest Rates

[For best visualization, read on the website here]

Journalism is all about a good headline, and poetry is about a good imagination. Can you suspend disbelief for a moment and imagine seeing this headline, say in March or April of this year?

“Fed Signals End of Easing Cycle, Eyes Interest Rate Hikes”

Now that would be a shocker, wouldn’t it?

The effect on risk assets would be devastating. At current valuations, the stock market depends on Fed easing. Tech stocks, because they are high-growth and therefore long “duration,” are most dependent.

This distant possibility hasn’t been priced into the stock market, and since this newsletter aims to provide its dear readers with investment inspiration, please play along for a bit.

At New Year’s, this was the two-pronged narrative surrounding the probable downward trajectory of the Fed’s overnight rate:

Economic: Inflation, currently at 2.8%, is moving down toward the Fed’s 2% target. This would allow the Fed to lower interest rates, which are currently pegged at 3.625%.

Political: Trump's pressure campaign on Chairman Jerome Powell to immediately lower rates, combined with his imminent appointment of a lackey as the next Fed Chairman, would inexorably result in lower rates. On many occasions, Trump has mentioned 1%-2% as a destination.

A week ago, Trump’s commitment to “controlling” the Fed reached a new high, with the Department of Justice ordering an investigation into possible fraud in the renovation of the Fed headquarters in Washington, D.C., the Eccles Building

Now, with our collective imagination, let’s turn the easing narrative on its head.

Deconstructing the economic narrative:

Lazard Inc., a white-shoe investment bank founded in 1848, published a research piece this weekend in which CEO Peter Orszag challenges the notion that inflation is coming down.

“The consensus view among forecasters is that inflation will continue its gradual descent toward the Federal Reserve’s 2 percent target through 2026. Similarly, market pricing suggests investors believe the Fed has largely won its inflation battle.

In our view, however, this optimism is premature. We think it is more likely that inflation will surprise to the upside.”

I will spare you the technical reasons for Orszag’s reticence to join the disinflation crowd, but if you have time, read the full article by clicking here.

Deconstructing the political narrative:

What if Trump can’t assume effective control of the Fed? What if it stays committed to inflation-fighting despite presidential pressure?

This alternative narrative brings to me the English nursery rhyme, “Mary, Mary, Quite Contrary,” which is even older than Lazard, dating back to 1744.

Mary, Mary, quite contrary,

How does your garden grow?

With silver bells and cockle shells

And pretty maids all in a row

Mary’s identity remains unknown, but my favorite version is that she was the English Queen Mary I, also known as Bloody Mary, who tried to reverse the Protestant Reformation started by her father, Henry VIII, by burning hundreds of Protestants at the stake.

If we swap Mary for Jerry, as in Jerome Powell, we get “Jerrry, Jerry, quite contrary” and we can fit this verbal acrobacy into a new poetic narrative.

Jerry, Jerry, Quite Contrary

How low do your interest rates go?

With silver bells and a new Eccles

You can tell Trump and Bessent where to go

Translated to prose, the more the President squeezes the Fed, the more contrary to lowering interest rates the Fed becomes, and the more Powell burns his Trumpian nemeses at the proverbial stake.

Could this new narrative be slowly replacing the old narrative?

Let’s see if the markets can tell us more than our imagination can.

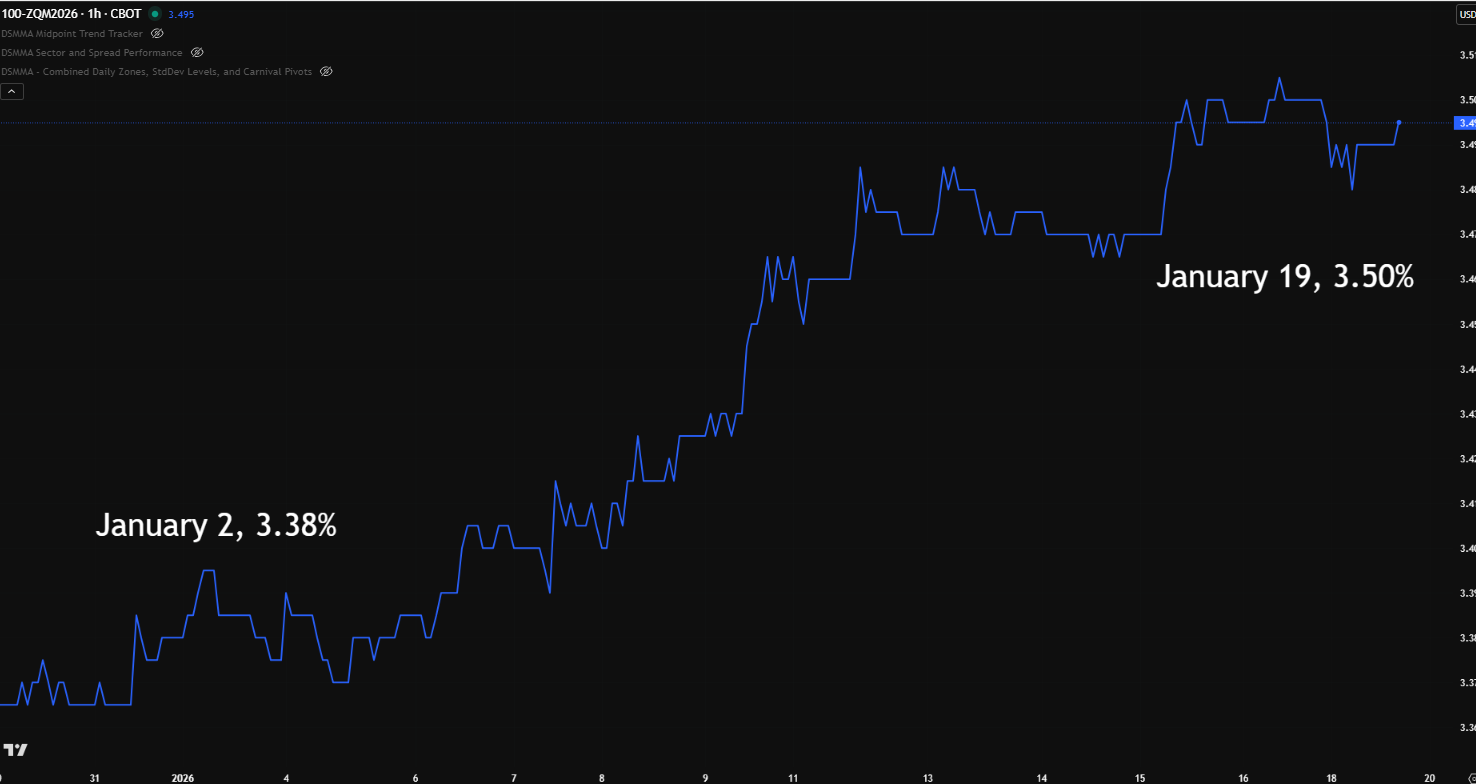

Here are Fed Fund futures for June 2026. Since New Year’s, rates haven’t gone down; they have gone up. On this 60-minute chart, one can see that the move has been twelve basis points. That might not seem like a lot, but considering we are talking about a horizon of less than six months, the move is significant.

Has Trump been hoisted by his own petard, to cite Shakespeare’s phrase? Has the bomb he hurled at the Fed blown up in his own face?

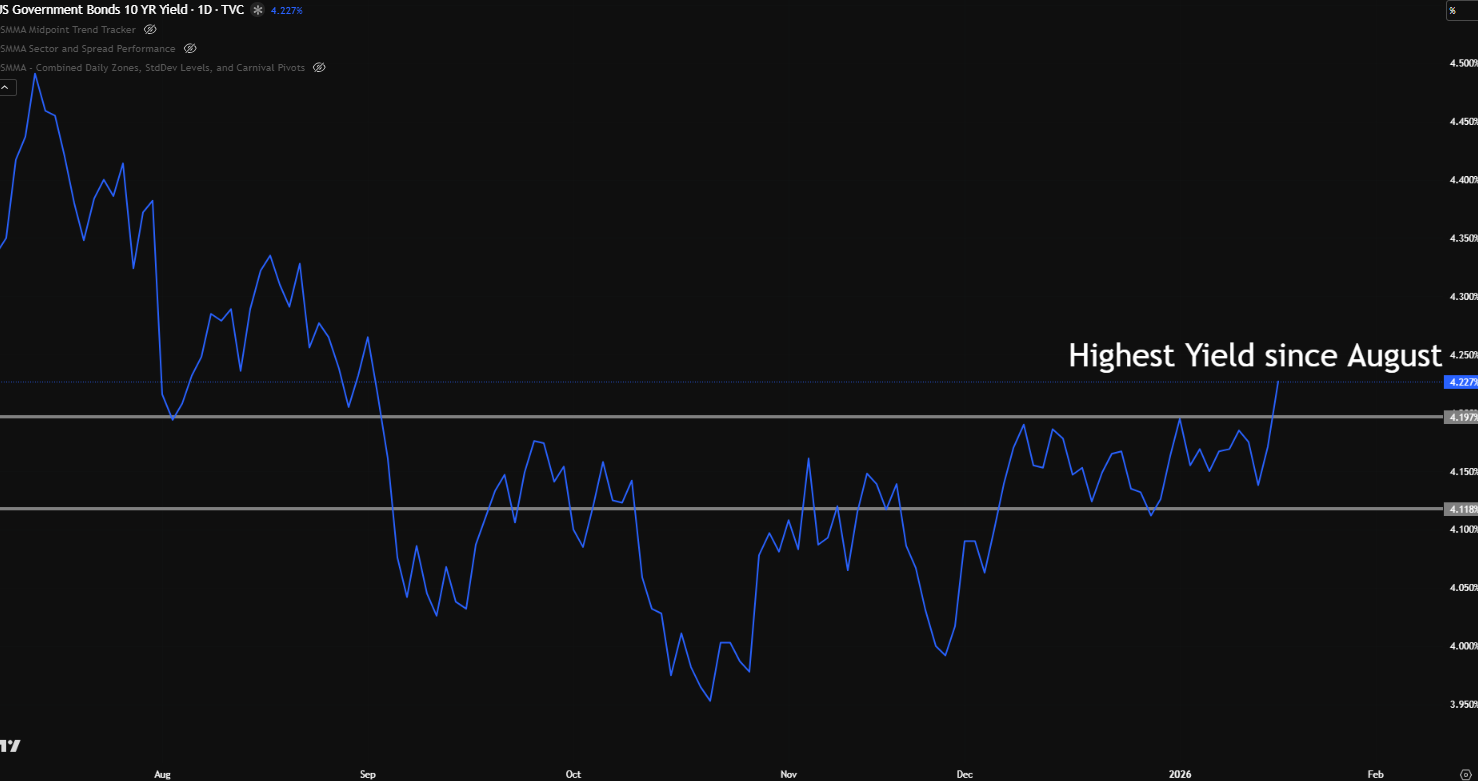

What about longer-term rates? The markets learned that the DoJ was investigating Powell on Sunday, January 11th. Since then, the 10-year Treasury - the benchmark most mortgages and corporate borrowing use - has broken out of its recent narrow trading range, and is now trading at the highest yield since August of last year.

This is the daily chart of the ten-year note yield:

The upward pressure on interest rates is not only a US problem; it is an international problem.

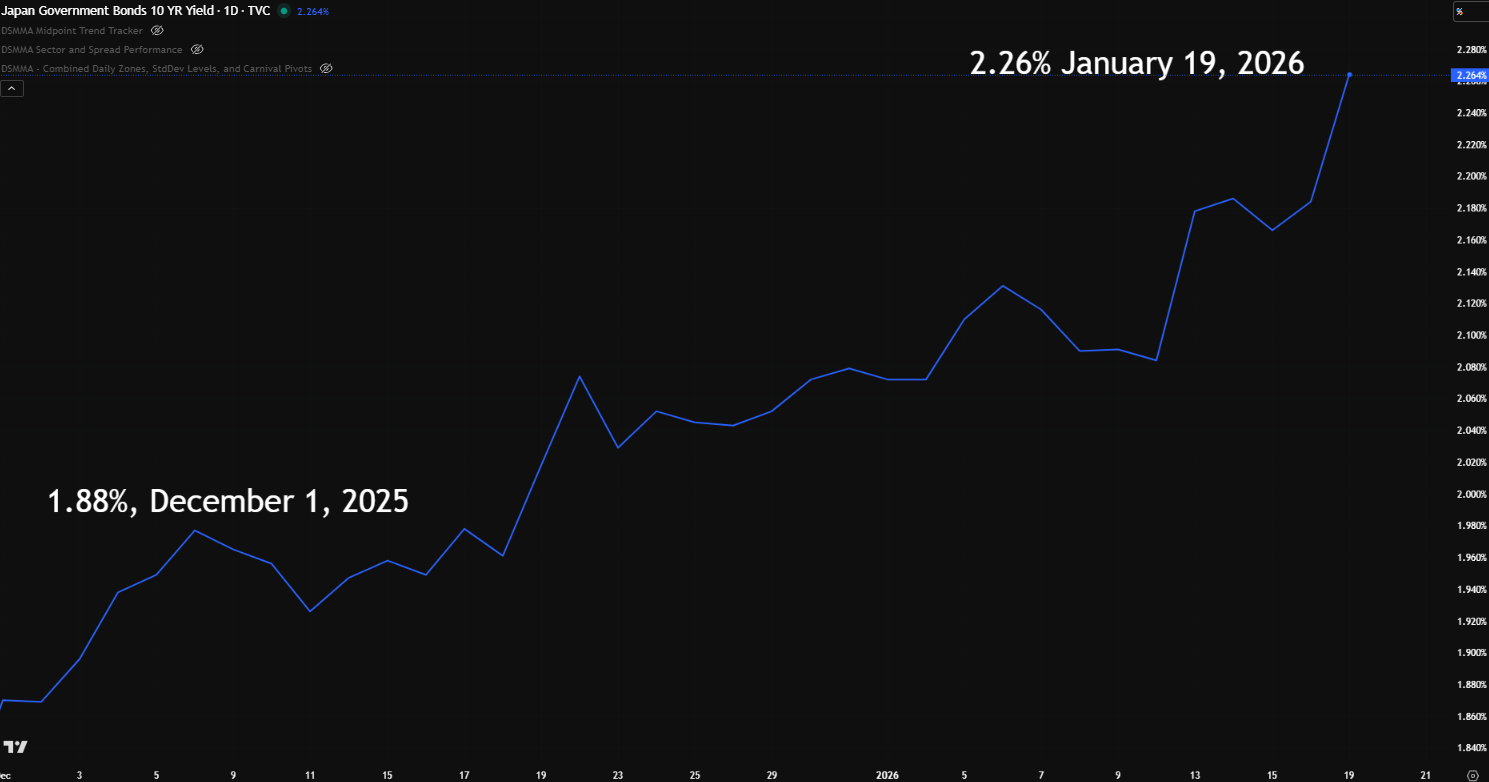

This daily chart of 10-year Japanese Government Bonds (JGB’s) shows what has happened to yields over the six weeks in the Land of the Rising Sun, which we could rename the Land of the Rising Yield.

Japan has not seen interest rates this high since the nineteen-nineties!

In Germany, long-term bond yields made a big move in December, with yields not seen since March of last year.

This is the 10-year German “bund” daily chart:

Maybe all of this concern about higher interest rates is just my imagination.

Isn’t it more likely that this is this summer’s headline?

“Fed Lower Rates to 2% and Signals More Cuts. President Trump Commemorate with Gala in New Ballroom.”

Stocks would be dancing to YMCA for months.

In A Midsummer Night’s Dream, Shakespeare’s whimsical romantic comedy, the character Theseus recites these lines:

The lunatic, the lover, and the poet

Are of imagination all compact.

Translation: Lunatics, lovers, and poets are driven by imagination, and not reason.

Which brings me to the musical conclusion of today’s post as we move from London Town to Motown.

Here are the Temptations on the Ed Sullivan show in 1971, foreshadowing my vision of a Fed raising interest rates in 2026.

Enjoy, “Just My Imagination.” And leave a like if you like.

Thanks!

David, thks for the excellent piece! Love the "adapted" rhyme. And, I too, think it may not be "just your imagination"...