A One-Man Trading Desk

From Japanomania 1989 to Trumponomics 2026

[For best visualization, read on the website here]

Just as President Trump kicked off 2025, he has come out of the gates this New Year with guns blazing. That is literally true in Venezuela, and with anti-government demonstrations in Iran triggering a government crackdown, the possibility for Trump to strike the country is on the rise. Certainly, the President is threatening such a move.

Perhaps it is domestically that the President’s New Year’s party has been most raucous.

The following is a short list of the more interventionist proposals he dropped in the first week of this year.

Cap credit card interest rates at 10% for one year

Cap Executive Pay in the Defense Industry

Increase Defense Spending by 50% to $1.5 Trillion a year

Ban large institutional investors from buying single-family homes

Direct government housing agencies Fannie Mae and Freddie Mac to purchase $200 billion worth of mortgage-backed securities (MBS).

My esteemed reader does not need to hear another “Donald Trump is not Ronald Reagan” truism. That Trump is as far from Reagan as I am from Mark Twain is abundantly clear. The President calls Republicans who don’t support him or his policies RINOS - “Republicans in Name Only,” which is ironic, considering that the Donald himself is a Republican in name only.

As I find myself once again criticizing a Trump proposal, a phrase Ronald Reagan himself uttered comes to mind.

“There you go again.”

That expression comes directly from the 1980 Presidential Debate, when Regan famously admonished Jimmy Carter, “There you go again!”

Please watch for yourself. If you are a boomer, then recall the good old days warmly. If you are a Millennial or a Zoomer, you will see how politics was conducted forty-five short years ago.

The irony: Reagan and Carter were debating one of today’s hot political topics - the absurdly high cost of health care.

The more things change, the more they stay the same.

Watch this twentieth-century American political classic:

Enough about Reagan. Let’s get back to analyzing what these proposed interventions may mean for the markets and the economy.

Apparently, Trump does have the capacity and legal basis to direct governmental housing agencies Fannie Mae and Freddy Mac to buy $200 billion of MBS, even if there is no financial crisis to warrant such a radical intervention.

As a quick refresher on fixed income, mortgage-backed securities are packages of residential mortgages that are sold to institutional investors. They yield more than US Treasuries for several reasons. First, unlike Treasuries, in the case of Fannie Mae and Freddy Mac, they are not backed by the full faith and credit of the US government. Second, they are “callable” bonds - because the US homeowner can refinance his or her mortgage when interest rates fall. That means the MBS holder has to reinvest the proceeds from the refinance at lower interest rates.

A fancy way of describing this is that a mortgage-backed security holder is short a call option, and that call option becomes more and more valuable (more “in the money”) as rates go down and refinances go up, making the cash flow of that security less predictable and less valuable. That is why MBS trade at a higher yield than US Treasuries.

After Trump’s announcement, from night to day, the spread - that extra yield MBS pay - fell by 15 basis points, to around ninety basis points “over” Treasuries. That means potential homeowners will pay less interest to buy a house, which is surely the intent ot Trump’s proposal. However, this represents new demand, which will put upward pressure on home prices. That cuts against the grain of the new bipartisan political mantra - “affordability.”

I myself began my career on the mortgage-backed trading desk of the investment bank Paine Webber back in 1986. Yes, go ahead and call me a dinosaur (but not a RINO!). Ronald Reagan was president then.

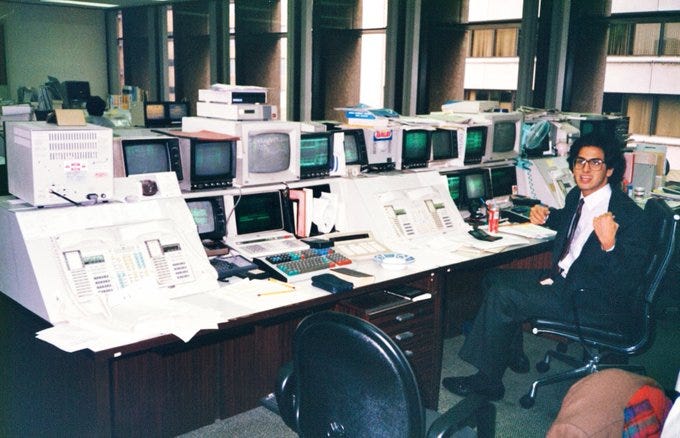

In 1989, the bank sent me to “run” the Tokyo branch. I use quotation marks because I was the only foreigner in the office, and worked with a handful of Japanese institutional salesmen who did not report to me. I was a trading desk of one. I was the Asia time zone PaineWebber Fixed Income Department.

My chief responsibility was as a US Treasury bond market-maker - to buy and sell US Treasuries from and to our Japanese client base in the Tokyo time zone. Insurance companies, trading houses, pension funds - the Japanese had become huge buyers of US Treasuries. In fact, Japan was at the top of the world in many respects, and by the end of the eighties, Japan instilled fear in Americans the way China does today.

Our office was in the AIG building, which bordered the grounds of the Imperial Palace in Otemachi. Japan was flying so high that it was estimated that the grounds of the Palace, about the size of Disneyland, were worth more than all of the real estate in California!

Japanomania was reinforced by the soaring Nikkei stock index. Two weeks after I arrived in Tokyo, as a single twenty-four-year-old, the index hit 39,000, which was the top for the next 30 years! It is the subject of another post, but boy was Tokyo rocking and rolling back then (and I am not talking about the markets).

Another responsibility I had as the fixed-income guy in the office was to market mortgage-backed securities to Japanese institutions. With beginner’s luck and some nice work by the salesman in the office, we started to see interest in these securities.

I reported their nascent interest to the “big swinging dicks” in New York - a phrase invented by Michael Lewis in his 1985 bestseller Liar’s Poker, which tells the story of bond giant Salomon Brothers, which, interestingly enough, was a competitor of PaineWebber back then. Sadly, neither institution is alive today. Salomon Brothers was incorporated into the Travelers group in 1997, and PaineWebber was swallowed up by UBS in 2000.

“Let’s make a market in MBS to the Japs overnight,” my boss on the mortgage desk told me, political correctness not having yet been born.

“Billy will send you a fax of where he can offer generics Ginnies (GNMA’s) on a spread basis to treasuries. Paul will send you a fax of where we can offer generic Fannies and Freddies (FNMA and FHLMC). All you gotta do is offer them out, and if we get lifted, then just buy 10 years treasury notes to neutralize the interest rate risk. “

Remember the discussion above? MBS trade at a spread to Treasuries. Treasuries trade 24 hours a day, even back then, but nobody traded MBS outside of the New York time zone.

With these marching orders, PaineWebber (and probably Salmon Brothers) initiated a very profitable run making markets in MBS in the Asian time zone.

If not every NY night (Tokyo day), almost every night, the Japanese would “lift” (purchase) $50 million to $100 million MBS from one of the handful of dealers that had sussed out this demand. When the New York traders arrived to work every morning, MBS would be quoted 1-2 basis points “tighter” in spread to Treasuries.

Initially, if I made a sale overnight, our NY traders would “cover” the short (sale) in the inter-dealer market that opened at 830 Eastern Standard Time. They, of course, had built in a cushion so that buying back the bonds in the open market in the NY am meant a profit.

You probably guessed our next step already. The NY traders would buy the MBS at the end of the New York session, sell the US Treasuries, and be “long” the spread before the beginning of the Tokyo session.

The Japanese continued to line up to buy MBS, and when we made a sale, I would buy back the Treasury short and send a fax with the “fill” to either Billy or Paul, depending on which issuer the customer had purchased.

“Done on $50 million Fannie 11’s.” This meant, on Paul’s behalf, I had sold MBS with an 11% interest rate to an institution and bought treasuries, netting Paul a profit versus the prices at which he had bought and sold at the end of the previous day’s New York session. Yes, the MBS yielded double digits then.

This completely legal positioning meant that the New York traders racked up even healthier profits after each trade. For this reason, they loved the kid who went to Tokyo and started the MBS business in Asia.

I don’t remember exactly how long the Japanese buying spree lasted. It was at least three months, and MBS spreads to Treasuries narrowed some 70 or 80 basis points during that time. This was a huge move, more than what Trump caused with his $200 billion announced purchase last week.

Yes, those were the days, when one didn’t need to be a PhD in Engineering or Applied Math or whatever to make good money on Wall Street. We weren’t doing anything wrong. In fact, I would argue the opposite.

By first educating the Japanese on the value of MBS and then intermediating their purchases of the bonds by providing them liquidity in their own time zone, we were able to achieve what Trump is trying to achieve - lowering the cost for Americans buying a home.

Whether Trump will be as successful remains to be seen.

The PaineWebber Japan Fixed Income Department (that is, me!),

ca.1990

Photo by Maurice Wolf, my Dad, rest in peace:

Please leave a like if you enjoyed this post, and share it with your friends and colleagues who might like to subscribe. Tell them it’s fun and free.