WHY does Technical Analysis Work?

An Exclusive Interview with Jimmy Jude, an All-American Trader

There is no doubt in my mind that technical analysis “works.” Countless profitable traders out there prove that every day. What has never been clear to me is “WHY” it works.

To try to answer this question of questions, I knew who to ask: James (Jimmy) Jude, also known simply as “JJ.” Jimmy is a principal at the consultancy service Damped Spring. More about Damped Spring later.

Jimmy is the real thing. He began his career as a lowly runner in the trading pits of the Chicago Mercantile Exchange in the nineties and successfully transformed himself into an all-around, all-asset-class, all-American trader whose specialty, developed over four decades, is technical analysis.

I interviewed Jimmy last week, and here is his story, in his own words. And read to the end if you would like to know Jimmy’s answer to the question – Why does Technical Analysis work?

Spoiler: I finally found someone who could answer that question for once and for all.

Early Days: From Ski Bum to the Trading Floor

David:

Let’s do it. How did you start in the business?

Jimmy:

I got into the business mostly on a lark. I was disillusioned after college. The economy was in recession around ‘92, I couldn’t get a job, and I was drifting around Colorado as a ski bum at the time. A couple of years out of college at this point, a college roommate called me and said he had secured a job on the floor of the Chicago Mercantile Exchange – the “Merc” - trading dollar yen options.

“You've got to get out here, you have to check this out. You need to see this.”

I didn’t know if he was talking about the floor or markets at the time, maybe a little bit of both. But as soon as I got on the trading floor, I knew that this was for me. I was immediately bitten by the bug, and at the very least, I thought this was going to be an amazing adventure and possibly a career.

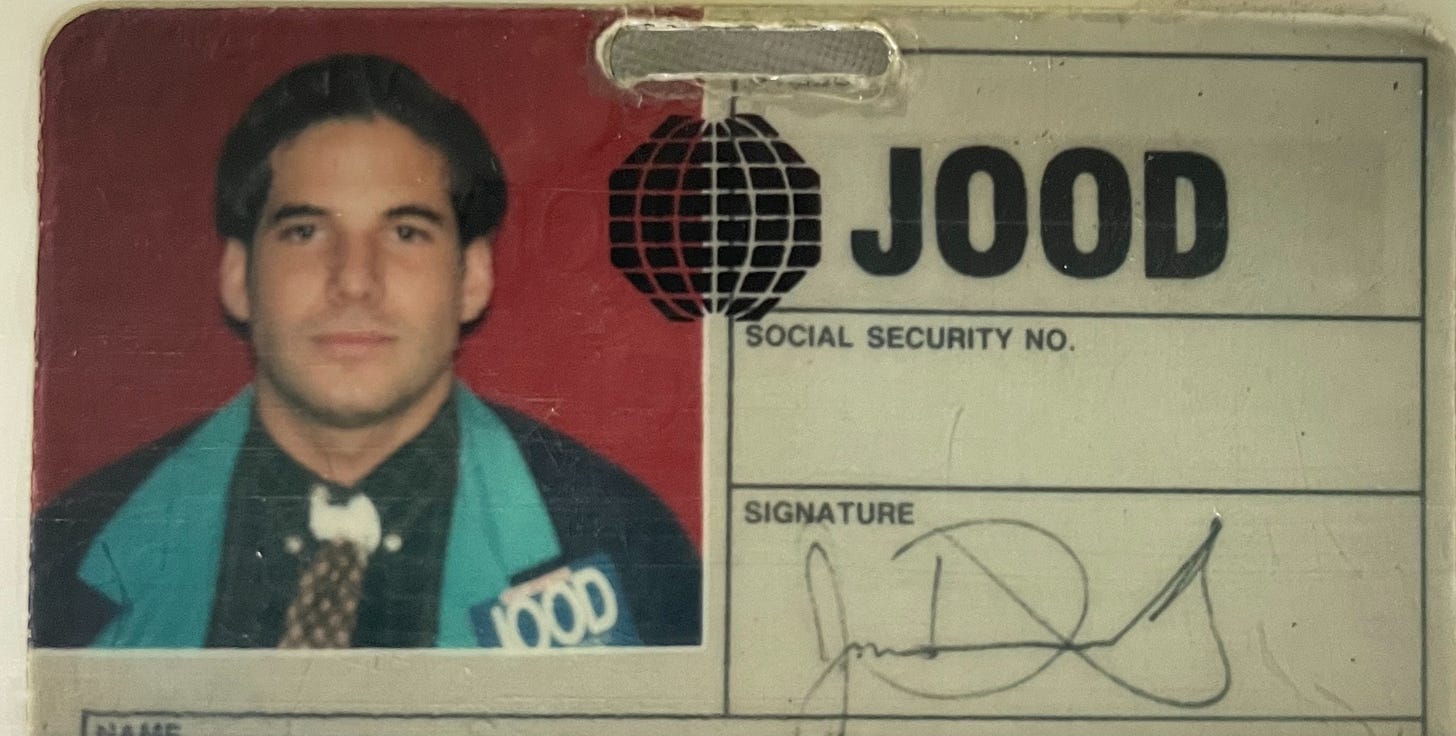

“This pic was taken about 15 min before I was going into the pit for the first time as a trader, and i knew i was about to have to fight my way in, lol.”

I started on the floor at a really great firm called First Continental Trading that actually moved guys up from the ground into clerk positions, and then into trader positions. There was some real mobility there. I worked my way from runner—who was filling the soda machine two years out of college with a college degree, a little embarrassed but whatever—and moved my way into the pit as a pit clerk first for the futures leg of all the option trades, then as an option clerk.

Each move was steadily more stressful. When you were the runner, you thought, “Jesus, I can’t wait to not be the runner anymore.” Then you become a pit clerk for the futures leg of all the option trades, and the stress level goes up 50X. You think, “Christ, I miss being a runner.”

Then you go into options clerking, handling positions for five option traders, collecting their trades. Your position had to be perfect because they’re making huge moves based on your calculations. The stress level goes up another 50X. Every leg in this journey, the stress level is multiplied. But it’s also a challenge. It was interesting—it was never not interesting. I’ll tell you that much.

So that’s how I got involved in it. But once I worked my way into the pit and into trading, then I really got bitten by the markets bug. I began in the Eurodollar options pit, which was the largest volume options pit on the planet at the time. It’s the SOFR market now—short-term US interest rates.

It had the baddest-ass traders in it, too—you had guys like Don Wilson, who runs DRW, a multi-billionaire now. Absolute geniuses. It wasn’t just geniuses, but it was geniuses who played linebacker at the University of Pennsylvania—they could beat your ass up and were smarter than you. It was a top environment.

Jimmy, on the right, on the Floor of the Merc, ca. 1995

Technical Analysis: “A bunch of bullshit!”

David:

Were you already doing technical analysis? How did that start?

Jimmy:

The CQG was an expensive data system that they had on the floor. All the old guys crowded around it. The young guys made fun of them, but I was always fascinated by it. I had gotten into the game and moved up so quickly into option market making and position management. I really lacked the experience of how the underlying instruments actually moved, so I was thirsty for that experience.

I would hang out at the CQG and talk to the old fellas all day long to try to pick their brains. It was an interesting conversation because there were five or six guys with 30–40 years in the business, all arguing over what they were seeing on the same chart. I got to stand behind them and listen to their conversations.

I didn’t add much at the time, but I was interested, and I didn’t bust their balls like the other guys on the floor. For that reason, they took me under their wing and started to show me a little bit.

But euro dollars wasn’t the greatest market to learn technicals on—it’s “chunky,” and you don’t see a lot of patterns. At that point, I started dabbling in the S&Ps. After the eurodollar trading closed, there was still an hour of S&P trading. I would run down and jump in that pit and trade the Spoos from the bottom of the pit—not even on a step.

The Spoo charts were actually showing me a bunch of patterns, and at least I could apply some of what I was learning. But I was getting smoked doing this. There was no success trading off the charts at the beginning.

“How are they doing this? This is bullshit! This really is just the scam that everyone says is it is - a self-fulfilling prophecy! It’s a bunch of bullshit.”

As my career progressed, the writing was on the wall for pit trading. The interest rate market was getting shitty. After 10 years in the pit, I was kind of looking to rotate out, expand my knowledge base, learn technicals, and understand how the underlying moves and why it moves the way it does—rather than always just being in the option pit, off guard, “like what the fuck was that?” never seeing anything coming.

Electronic Trading: Pure Technicals

Jimmy:

An interesting part of that was that I hired a kid out of college to be my clerk when I was in the options pit. He was fantastic. He became a trader with me. He left the Merc to go into electronic trading because he didn’t want to be in the pit anymore and wanted to go to screen trading. I had taught him everything I knew about pit trading, and then he dragged me to that electronic firm and taught me everything.

This firm was amazing. They had about one hundred traders, purely technical. It was a complete immersion into technicals because all your edges had to be manufactured by the charts. There were no more pit edges. Everything was this giant mosaic blend. Your ancillary markets plus your market.

It was a really cool way of learning. It was very organic. They let me trade any market I wanted. I had full access, so I really got to see that yes, there were different nuances to every chart, but in reality, all these markets were all moving in the same patterns, the same waves—they may have been moving at different speeds and in different timeframes, but generally, they were making the same overall patterns and movements.

They taught that markets were this organic beast because they were made up of humans—human interaction, humans bought-and-sold, and the emotions that went into it. This was back when markets were really making cleaner patterns too, in ‘04–’05, before the algos (algorithmic trading) muddied the picture a little bit.

You could actually read order flow on your screen, and the markets were making super-clean patterns at the time. It was a terrific time to learn.

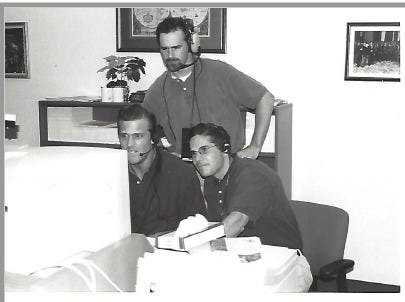

Jimmy learning how to “trade the screens.” ca. 2004.

The Markets: A Living Organism

Jimmy:

Getting back to it, the markets were moving in the same general pattern, and I think that gave me an edge, too. A lot of people start in markets, and they look at the technicals, and they look at one market—how can I anticipate what is going to happen from just one chart? In reality, you should be looking at all the markets and seeing how markets move in general together.

Then it starts opening up the world of what technicals really are and why they happen. They happen because there’s a human element to them—even if it’s an algorithm, a human programmed the algo. There’s emotion involved. There’s history involved, price history.

There are all sorts of components that go into price movement, but when broken down, it’s an organism. The markets are these natural organisms. That’s why you see a lot of the movement in waves —the same type of mathematical patterns show up in the Fibonacci sequence and the rings of a tree.

So deep down inside, that’s why I feel the root base of technicals and technical analysis is that it’s human-based and nature-based. I’m not saying that they’re perfect; they are a roadmap of the highest probability of where the market is going.

Fundamentals can knock technicals off course, tape bombs [unexpected headlines], stuff like that. But I equate it to when you make a wrong turn, and you don’t know where the fuck you’re going, and suddenly your phone or Waze redirects your route and says, “Okay, now you’ve got to turn left up here.” That’s kind of how technicals are.

Maybe it’s a unique experience too, because my experience was unique—starting with the old guys on the floor teaching me the history of this stuff before there was any technology, and then transferring that into the era of algos and high-speed trading. Then the charts started to get a little slippery because the algos knew where the technical guys were coming in.

So it was always morphing, and it still is today. Technical analysis is never something you say, “All right, I’m done, I know it all now.” You never stop learning about it. I’m never arrogant enough to think that I found the grail or turned the corner, because it’s constantly morphing. But there is a measurable rhythm to it.

It’s fantastic for trade execution in order to optimize your entries and exits. At the very least, even if you’re not going to get to the point where you can actually read the future moves in the markets, it’s a great tool to learn for entries and exits. That’s the kicker to it.

I don’t consider myself a technician. I consider myself a trader who looks at technicals.

Technical Analysis: Why does it work?

David:

Jimmy, what sticks out to me is your analogy of the market to a living organism. Is this what you are saying: The natural world is governed by certain immutable laws, and some of those immutable laws can be applied to the imperfect world of humans trading. Is that fair?

Jimmy:

The answer is absolutely. I ask those questions of myself during the most insane moments of the market, too. I think it was Christmas Eve 2018—illiquid markets, the 2018 markets were dumping into nothing. And I was thinking, “Why?” I had certain areas lined up on the charts where I wanted to dig in, and there was nothing there—they were gliding through these prices with no volume.

Why is it going to stop here? Why do I know that this is where I want to get in? I guess it’s a combination. First, you definitely have the natural rhythms of the market. But you also have, when the market breaks loose of its moorings and starts really ripping around, the only ones left that can actually set the bar are the technicians that can come in, set the market straight, and give a reason why you should be stepping in front of this train.

And there can’t just be one reason—there have to be layers in your technical analysis. It’s almost the last layer: “Yes, and it makes sense because of this.”

David:

Well, there are two things I’ve been very impressed with you—this is really sincere.

One, as you say, the importance of the ancillary markets—you’re rarely observing one market; you’re usually hooked up other related markets.

And the other thing - it has a little bit to do with my liberal arts background - is that you are extraordinarily articulate in taking market observations, technical observations, and putting them into almost poetic language.

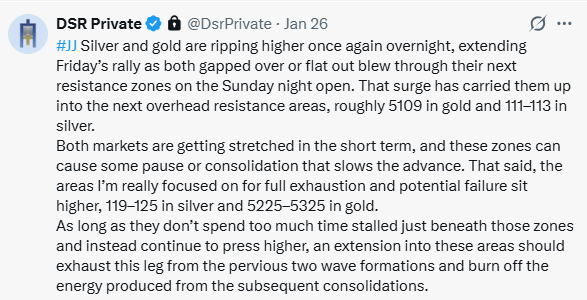

Jimmy’s poetic technical analysis of Silver Futures on January 26, 2026

Jimmy:

Yeah, that’s high praise, David. Thank you very much. And it probably comes from 30 years of grinding, putting in the time, putting in that screen time, being in front of these screens since ‘05. What was kind of interesting—what I got to do—was the biggest dream ever.

I went to the floor. I went to the electronic trading firm. After I went electronic, I started trading on the screens. I loved it. I really started picking it up and getting the patterns and the rhythms of the market. I wish I could have had this in the pit—I could have murdered it. I would have been deadly with this knowledge.

And then here is a good story: The owner of the company comes up to me and says, “Listen, we have an opportunity here. Natural gas is going fucking crazy. One of our biggest traders is trading this new ICE product versus the NYMEX product, and he needs a guy in the pit. You’re the only guy who has the experience to do this. We would need to send you to NYMEX in New York.”

The reason this was all happening was that [Hurricane] Katrina had hit, and gas had gone from 5 bucks to 15 bucks.

I had a one-year-old at home, but I said, “Yeah, I’ll definitely do that. When do you want me to go? Fuck, yeah.”

He said, “This weekend.”

I’m thinking, “I am going to go home and tell my wife we are moving to Manhattan this weekend.”

But I got to go back in the pit, armed with all of this new technical knowledge, and I “murdered” people. I literally murdered them. It was exactly the way I thought it was going to be—these goons standing next to me trying to intimidate me, hitting me with size, where I knew there was rock-solid support, trying to muscle me.

I was just, “Hit me with your size, brother, I will buy whatever your size.” It was the most wonderful pit experience of my life!

But it also lent more credence to the fact that these things do work. There is something about it—for every time you ask me about a price level, I have a reason, a story, and an emotion, and why I want to do this.

It is not just because they are “old highs” or whatever.

Young Traders: Look at all markets, but keep your day job

David:

It is kind of a cliché, but what types of things young people should think about, especially for the Brazilians who are reading this, who might not have had the luck to find a job on Wall Street?

Jimmy:

I think first of all, trading is a part-time job, especially if you really love it and you really want to get into it and learn the craft. It really is a craft. It takes some time to learn it correctly—just a little experience and screen time. But in the meantime, don’t put pressure on top of it by making it your end-all and be-all.

Don’t make it your only job. Always have a job, always have the second “gig” providing liquidity to your living as you’re learning, because you don’t want to learn under pressure. You want to take the process slowly and do it correctly.

A lot of people you see do it quickly, get rich in their first couple of years because they are trading a bull market, as we have now. They kick ass, they quit their job, and then it gets complicated. Suddenly, when the pressure sets in, you really start dealing with the psychological aspects of trading. You don’t want to do that right away.

Learn slowly.

David:

Are you saying that it is okay if you start trading as a hobby? Something you have a passion for, but you don’t do it full-time? Is it possible to learn that way?

Jimmy:

For sure, and it’s never been more accessible. You can literally put a few hundred bucks in a NinjaTrader account, get a charting program for 50 bucks a month. You can listen to assholes like me talk shit on Twitter and learn that way

It’s a cheap entry.

Back when I started, it took a quarter million bucks to throw into an account to start. It cost 1200 bucks a month for data back then.

Everything was fucking expensive. Now it’s all cheap, so you can do it on the side, at your own pace. And who knows—maybe you’re quick, maybe you build it up.

I tell you, one of the most successful traders I ever knew was a guy who, after college, was parking cars—he was a valet. He started trading and refused to quit his valet job because he made so much cash doing it in downtown Chicago, outside a Morton’s Steakhouse.

Then he made seven figures trading in one year and was still valeting cars! He was driving around in a $200,000 Porsche.

After the markets closed one day, I asked him,

“Where are you going tonight? You want to go out?”

“No, I have to go to work.”

“You are not still valeting tonight, are you?”

“Yeah, fuck that, I am valeting.”

And I understood why he didn’t quit parking cars.

“No, no, I’m not quitting that. The second I quit that, the pressure changes everything.”

David:

Thanks, Jimmy, the wolf of wall street and his dear readers appreciate your time and wisdom.

Jimmy and Damped Spring Partner Andy Constan talking markets last Sunday night.

Editor’s Note:

Jimmy is a partner with Andy Constan and Nik Lentz at Damped Spring, a proprietary consultancy that advises both institutional clients and private investors. If you would like to learn more about Damped Spring, click here

And naturally, Jimmy continues to trade the natural rhythms of the markets.

Follow him on X, @Jimmyjude13

Thanks David, and thanks Jimmy! Been looking forward to this interview!

Whenever I think about TA, I'm reminded of the spanish saying... "no creo en brujas, pero que las hay, las hay" 😉

Loved the part about technicals being rooted in natural rhythms not just psychology. The organism analogy makes way more sense than most explanations I've heard tbh. I tried doing the pure chart thing for awhile but always felt like something was missing untill I started looking at the ancillary markets like Jimmy mentioned.