What NEVER To Do To Your Portfolio

Macro Monitor, September 7, 2025

Never-Never Land

Peter Pan’s “Never-Never Land” is an island where time and aging are perpetually suspended, where everyone and everything is blessed with eternal youth.

Dear reader, you won’t live forever, but you need to allocate your savings today so that they last, if not eternally, as far into the future as possible.

Nomenclature: Alpha x Beta

First, let’s define the difference between trading and investing, using industry nomenclature.

“Alpha” is pure trading. It is a quest to identify market excesses that provide a perceived subtle edge to risk-taking. Alpha is hard, as I can testify firsthand, having attempted to squeeze profits out of efficient markets for thirty years. An example of an Alpha position I currently hold is a long “put spread” on the S&P (an option strategy with a payout of approximately 5 to 1 if the S&P falls by 5% by mid-October). It is speculation, not investment.

“Beta” refers to building a diversified investment portfolio that will protect your future purchasing power (with anti-inflation assets) while providing a positive return correlated with economic growth (with pro-growth assets). Think of it as money today working to protect against the erosion of money tomorrow.

Alpha is sexy and transient; Beta is boring and lasting.

But Beta is not a simple “buy and hold” strategy. Beta investing is the process of dynamic asset allocation, a topic we covered in an April post, and will continue here with real-life examples.

We intend that this brief discussion inspires you, my dear reader, to review your investment portfolio and investment process to ensure you NEVER break any of the six rules that follow.

Rule 1: Never Risk More in Alpha than Beta

Considering transaction costs and the fact that you are competing against the greatest financial minds of machines of Wall Street (present company excluded), it is a near certainty that you will lose money trading Alpha, but Beta, on the other hand, will likely provide for your future well-being.*

Rule 2: Never Unbalance

In last week’s post, we discussed the outperformance of the ETF GDXJ, which holds small gold mining companies. The gold fever continued during the week, and GDXJ added another 7% to its yearly gain, which has reached a shocking 99%. A 2% allocation I made a year ago had become pleasantly but uncomfortably large at 4%.

With the “Fear of Missing Out” (on more momentum-based profits) in my heart, I decided to go to a zero allocation in GDXJ. My brain told me that at its present price, GDXJ no longer offered asymmetric returns, and with a volatility approximately three times that of gold (it is a leveraged bet on gold), a reversal in the gold rally would especially punish the miners.

I made this portfolio shift on Thursday, before Friday’s employment report. I parked the money in cash, which was a mistake.

Rule 3: Never Not Reinvest

In my approach to asset allocation, there are two steps to decision-making:

a. How much should I invest in the markets versus how much I should be in cash dollars?

b. How do I allocate the portion that is committed to market risk?

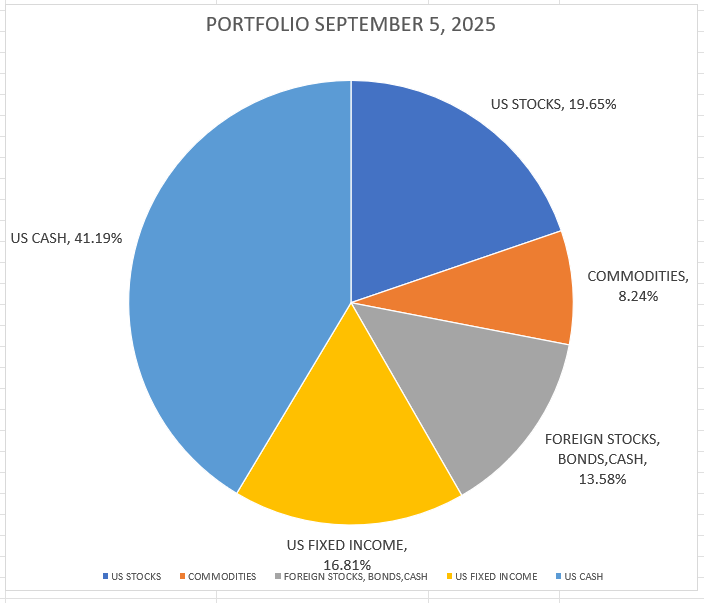

I am a conservative investor, and my cash stands at around 40%. That is my level of comfort given the macro fundamentals today - not yours. If your investment horizon is ten or more years, then your cash level need not exceed 25%. If the market moves against you, you have a “lifetime” to recover.

If you are a wizened wolf like me, then you only go to a full allocation to risk assets when the macro winds are uniformly at your back. I don’t believe that to be the case today, but that is not the subject of this post.

Back to Friday’s employment report. It surprised (shocked?) to the downside. In fact, with the revisions of past months, the market has started talking about a “jobs recession.” This is the chart of job creation month by month, clearly showing its path toward zero.

With the jobs print, the market instantly priced a 3% terminal rate for overnight Fed Funds by the end of 2026, down from 4.33% today. Treasury bonds rallied, the dollar fell, and gold, reacting to lower real interest rates, spiked 1% on the news. Traders had “Disco Fever.”**

The gold miners rallied 2%, but selling them had not been a mistake. Remember, never unbalance. My mistake was not reallocating the proceeds of my sale to another asset. As a result, 4% of my portfolio didn’t work for me on Friday when almost everything went up.

Rule 4: Never Too Late to Allocate

Although long-term Treasuries had rallied Friday morning more than one percent in price, I bit the bullet and reinvested the 4% in the ETF TLT, which holds Treasury securities with a 20-year maturity. The macro motivation behind this better-late-than-never decision was to prepare for a larger slowdown than is priced by the market, and increase my allocation to pro-deflation assets.

Rule 5: Never De-Diversify

It may sound like all of my trades go swimmingly well, but they don’t. One example is the ETF XLE, which holds the largest American energy sector stocks (mostly oil companies). Oil fell 3% Friday, and XLE fell 2%, as they are pro-growth assets.

I will not rush to exit XLE on Monday morning. An enduring portfolio is one that an investor can never “de-diversify”, which is one of the best triple negatives I have ever written. Some components of a diversified portfolio will ring the register when the macro changes (as it might have on Friday), while others will take a hit. The net is your investment return, and if you can keep pace with inflation in hard times, then you will be alive to hit a home run in better times.

Rule 6: Never Favor a Stock Over an ETF

An ETF (Exchange-traded Fund) is an investment fund that holds a diversified portfolio of assets, like stocks, bonds, or commodities, and is traded on stock exchanges like a single stock, typically tracking a specific index or sector.

ETFs rock because they offer the investor instant diversification, almost for free. Imagine buying all 500 stocks in the correct proportion to gain exposure to the Standard and Poor 500 Index. Just buy the ETF “SPY. The pro-growth oil producer ETF cited above, “XLE”, has holdings in twenty-five companies. Can you imagine buying each of these oil producers and energy service providers one by one, and then keeping track of them?

Occasionally, I will discover a “single name” (individual company) stock that I “like,” but given my limited capacity to know its micro-fundamentals, I limit its participation to 0.50% of my portfolio. Today, I own the Chinese car manufacturer BYD, the AI darling Broadcom, the drug giant Eli Lily, and the meat packer JBS.

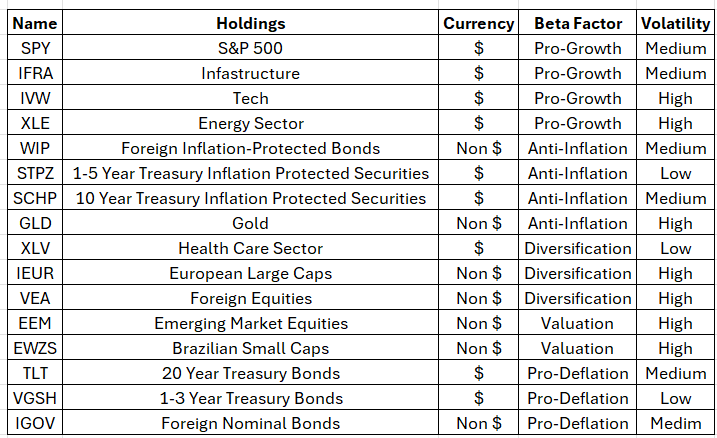

More importantly, I own the following ETFs. They are summarized in this ETF “cheat sheet” below.

The great news is that all of these ETFs have very low expense ratios. Avoiding transaction costs makes a huge difference to portfolio return over time.

Conclusion

I hope these principles of what NEVER to do have been helpful. Because investing is about preserving today, tomorrow’s purchasing power, I chose to use the negative “NEVER” instead of an affirmative as a reminder that the best offense in investing is a good defense. And a little luck never hurt.

As Peter Pan said, “All you need is faith, trust, and a little bit of pixie dust.”

For inspirational purposes only, I have printed my current Beta portfolio.

May it, and yours, live forever!

*I follow macro investor Andy Constan closely, and some of his ideas have seeped into my work. You can read more about them here. Follow him on X too.

**Back in the day - the eighties and nineties - when the market got a whiff that the Fed would be lowering interest rates via the Fed Discount Rate, traders would buy, buy, buy, in a wave of “Disco Fever.” Friday was a classic example of Disco Fever.

The Macro Monitor

This week’s Monitor is sending a neutral signal, as momentum and the economy wane.