Politically, geopolitically, and economically, Donald Trump is attempting to change the world order. As a result, market dynamics have changed.

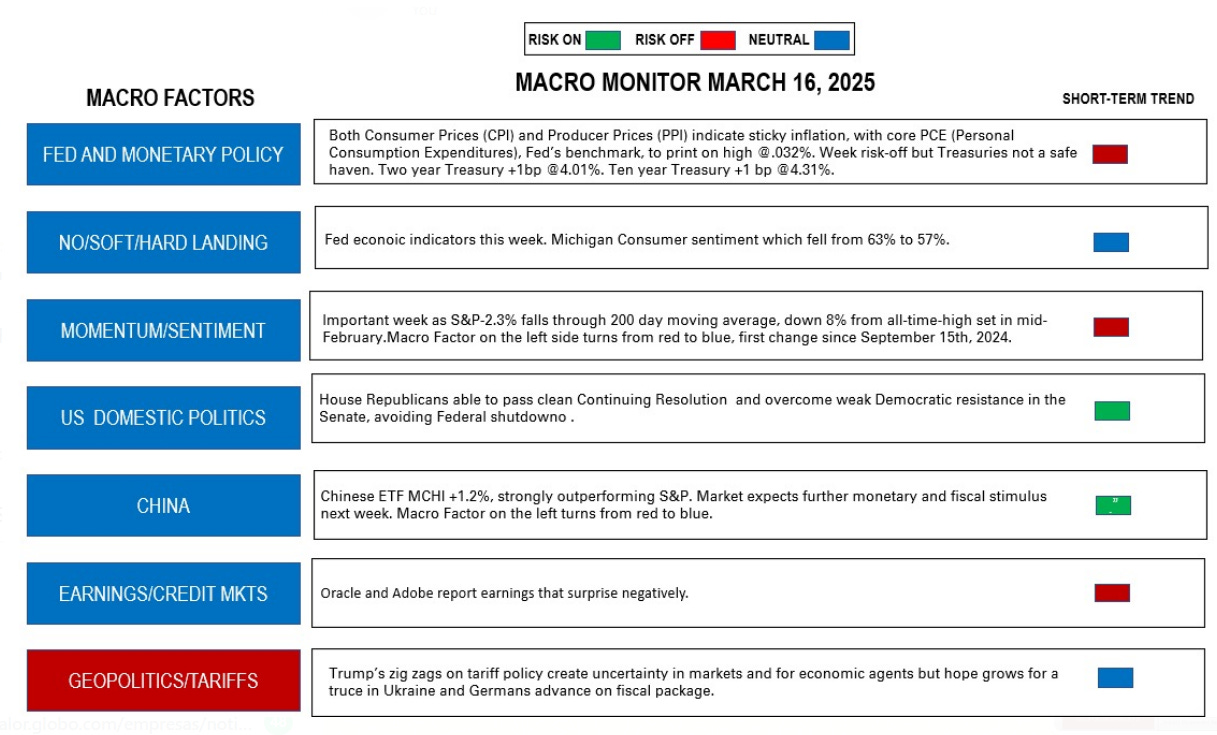

I have developed the “Macro Monitor” over twenty years. Part of its usefulness is that it is a subjective model, one that I can change, whenever I think a change is warranted.

This week, I have moved the long-term “Momentum/Sentiment” Macro Factor from green to blue and the long-term “China” Macro Factor from red to green. In other words, Momentum/Sentiment has moved from indicating “risk-on” to neutral, and China has moved from indicating “risk-off” to neutral.

One of the most important technical indicators traders consider when assessing momentum in the markets is the 200-day moving average. If today’s price of an asset is above the average of its closing prices from the last 200 days of trading (almost a year), then that is a positive signal. The bulls are in control. The opposite is also true. When the average is below the current price, the bears have taken over.

This is what happened last week. The market fell and closed below its 200-day moving average for the first time in over a year

So point number one - the market no longer has positive momentum.

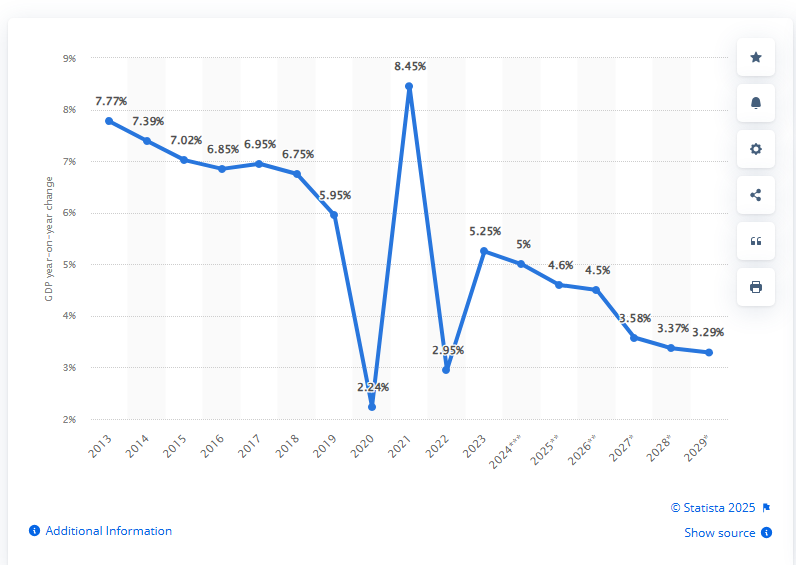

Point number two is the China Factor. The chart below shows, excluding the Covid slump, bump and slump (China had two shut-downs), the steady decline in GDP growth from the world’s second largest economy.

in 2025, China still finds itself in producer price deflation that translates into falling home prices and stagnate consumer and business confidence. Yet, two events may be turning the China story around.

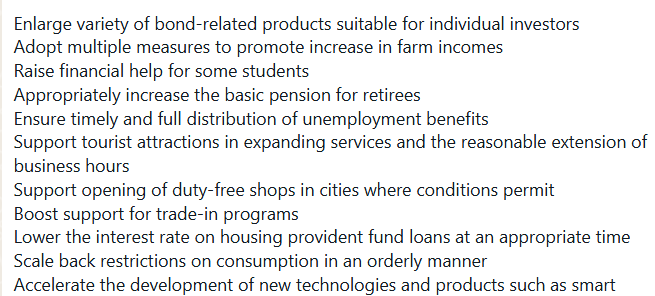

In September of last year, the Chinese Government announced its intention to ease monetary conditions and increase fiscal spending to shore up the moribund banking sector. (Read the wolf of wall street’s post on “The Chinese Bazooka” here). These measures have begun to turn sentiment around. Just yesterday, the State Council committed itself to a host of pro-growth initiatives:

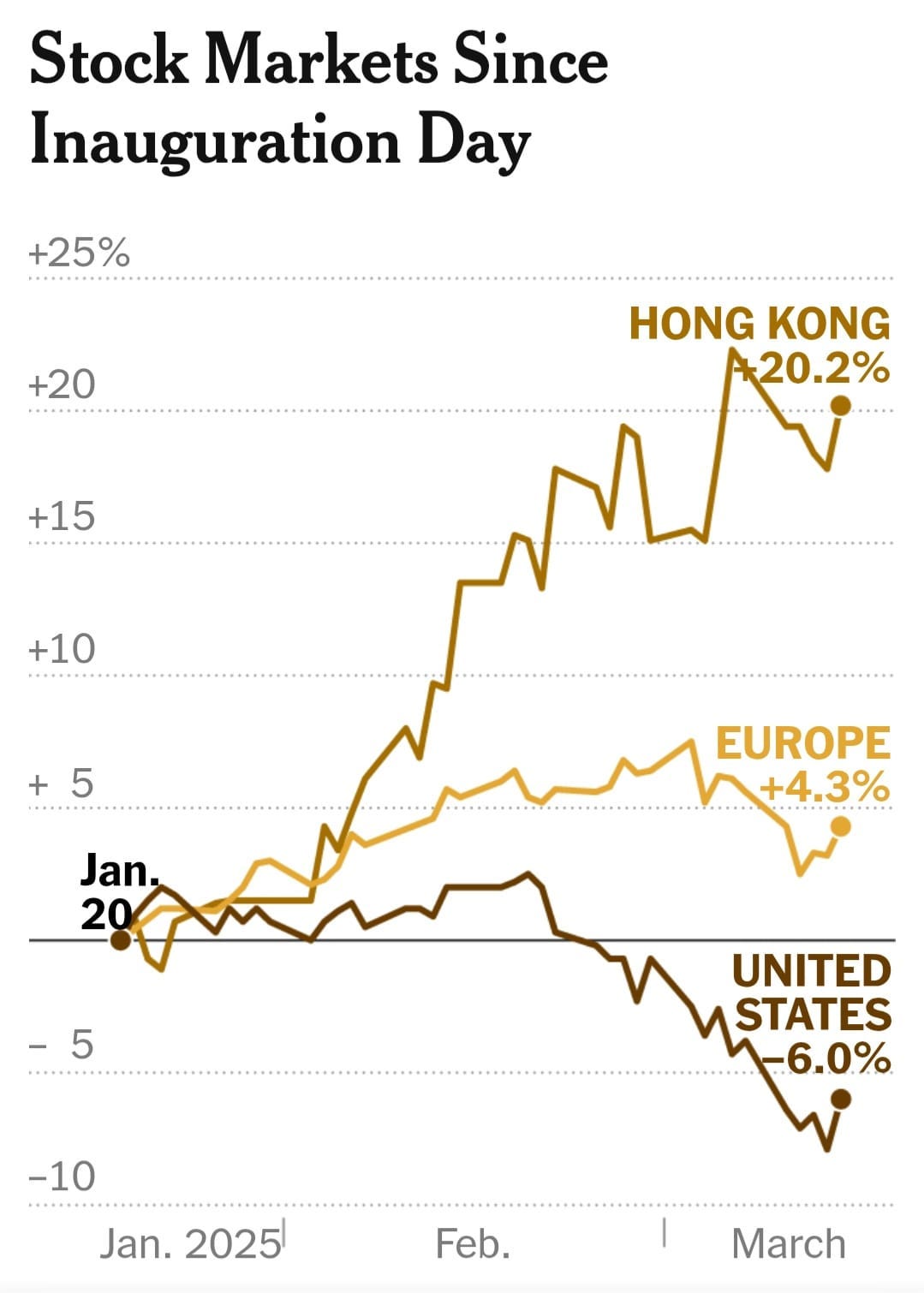

The second China trigger came in mid-January of this year, when the AI model “Deep Seek” was released. The now named “Deep Seek Moment” made markets question “American Exceptionalism” and most directly, its leadership in the technology sector. That led to a “rotation” out of US tech stocks (especially the Magnificent Seven) to other world markets, especially Chinese equities.

Since the beginning of 2025, Chinese stocks (the ETF “MCHI”) are up 22% while the S&P, having lost its momentum, is down 5%.

Could Donald Trump’s iconoclastic words and actions and principles and policies explain the shift in the flow of funds?

Before answering that question, let’s look at three additional data points. As we have discussed here often, the S&P is going down largely because investors fear an economic slowdown, the product of tariff, Doge, Immigration, and tax policy uncertainties.

Economic slowdowns traditionally mean that bond yields fall. Market chaos, as we have witnessed in US equities over the past thirty days, creates a “flight to quality,” where investors purchase “safe haven” defensive assets like US bonds. In March, the S&P has traded down roughly 5% while the interest rate on the ten-year Treasury has increased by 11 bps. Doesn’t anyone want dollar-bonds?

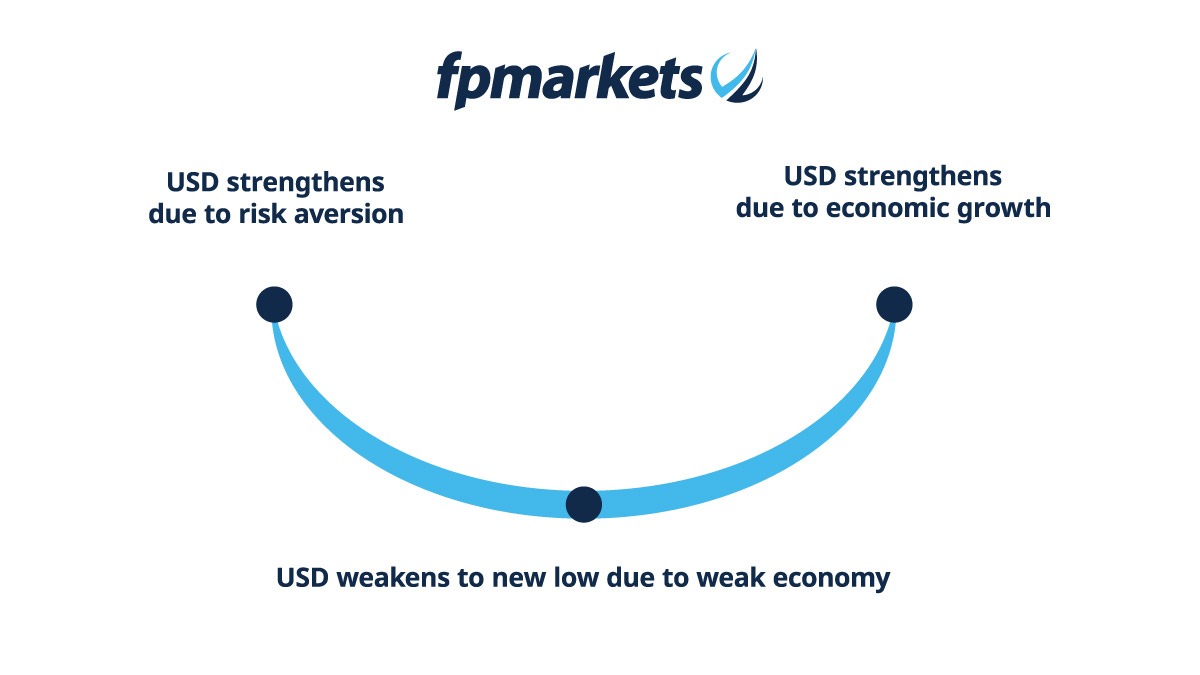

Second data point: In times of crisis, investors seek the safe haven of the US dollar. That could be to escape capital markets volatility or because lower global economic growth means a lower US trade deficit. A lower trade deficit means that the US imports less goods and services. The flip side of that is that it exports less dollars to pay for those goods and services. Less dollars in the global system = higher US dollar.

This has been known as the dollar smile.

When Trump was elected, the dollar soared on expectations that his administration US economic growth would gallop led by de-regulation, lower energy prices, and the extension of tax cuts. That is the right side of the smile above.

We are now amid a classic risk aversion, with the S&P falling almost 10% in less than a month. That is the left side of the smile.

Since the S&P made its last all-time high on February 20th, the Euro has appreciated 4.50% against the USD and the Japanese Yen 2.50%.

Most intriguing is that the Mexican Peso has appreciated 3% against the USD since then. What, Mexico, the object of Trump’s fenatyl tariffs and the world’s economy most exposed to the United States?

In a crisis, the dollar generally goes up, but when the dollar is the crisis, it doesn’t.

Gold is the third example. When you buy gold, you pay for it in dollars. Another way of saying this is that when you sell dollars you receive gold. Gold hit a record $3,000 this week, which is another way of saying the US dollar hit a record low against gold.

Something is rotten in the kingdom of Trump, and that just might be the US dollar.

I hypothesize that Trump’s Make America Great Again policy may be also termed “Make the Dollar Break Again.” Whether intentional or not, Trumponomics may be permanently altering the flow of investor funds. Why should surplus countries continue to recycle their export dollars into US treasuries, real estate or Magnificent Seven Stocks, when, for the time being, US friendship, protection, trade policy, and rule of law is uncertain?

I don’t like to give investment advice here but should point out that diversification is important in any portfolio, which should not only have a mix of asset classes (equities, bonds, and commodities) but also a mix of currencies. (Read “Is Portfolio Diversification a Free Lunch” here).

Now, esteemed reader, is a good time to consider diversifying into non-dollar investments, be that commodities or foreign bonds and stocks.

The Macro Monitor has predicted “risk-off” (with regard to the S&P) correctly for the last three weeks. Even with the changes in the long-term factors mentioned at the outset of this week’s post, this week the Monitor once again flashes “risk-off,” based on short-term relative weakness in US treasuries and the market falling and staying below its 200-day moving average.

Disclaimer: The content of this post reflects only the views of the author and not necessarily those of Armor Capital.

Love this blog! My only contribution to this analysis would be to point out that equity valuations were on historic highs and not immune to the reversion to the mean gravity. I believe the bond market is a more appropriate barometer of the national economy.