As Americans look forward to Independence Day, 2025, on Friday, July 4th, the markets are looking away from the Independence of the Federal Reserve.

In this post, we will quickly look at how the Fed works, how politics is threatening its independence, and what that means for the markets.

How the Fed Works

The Fed’s traditional policy lever is the Federal Funds Rate, which is its target for the overnight rate at which banks lend to each other in the money markets. The current target for the Fed Funds rate is 4.25% to 4.50%. The Fed has a plethora of technical mechanisms it employs to ensure that overnight interbank lending falls within its range; for simplicity, we can say it“controls” the Fed Funds rate by fixing a floor on the rate it borrows from banks and fixes a ceiling on the rate it lends to the banking system.

The Fed Funds rate is set by the Federal Open Market Committee (FOMC), which consists of 12 voting members that meet eight times a year (approximately every six weeks). Its decisions are intended to achieve its dual mandate - price stability (inflation) and maximum employment (growth). The Fed must be independent from political pressure to achieve these objectives.

The FOMC includes:

Seven members of the Federal Reserve Board of Governors, including the Chair and Vice Chair.

The President of the Federal Reserve Bank of New York, who has a permanent voting seat.

Four presidents from the other 11 Federal Reserve Banks serve one-year terms on a rotating basis.

There are twelve Federal Reserve district banks (think of them as “branches” of the Fed - Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, San Francisco). The Presidents of each District are chosen internally by the Fed and are therefore apolitical.

By contrast, the seven Fed Governors are political appointments. When the fourteen-year term of a Governor ends, the President of the United States nominates a candidate for Governor who is subject to confirmation by a simple majority of the Senate.

Additionally, every four years, the President nominates one of the seven Fed Governors as the Central Bank’s Chairman. This appointment is also subject to confirmation by the Senate.

Although the Fed establishes and maintains a level for the overnight Fed Funds rate, it does not and cannot control long-term interest rates. These are determined by supply and demand. Demand is a function of the market’s expectation for the trajectory of the overnight rate, PLUS its expectations for future inflation. Supply is a function of the mix of short, medium, and long-term debt (Treasury bills, notes, and bonds) that the US Treasury determines optimal for financing the trillions of dollars of deficit spending. The more long-term debt that is issued, the higher long-term rates may go.

Politics and the Fed

It would be the understatement of the year to say that President Trump is not happy with the current Fed Chairman, Jerome Powell. Poor Powell. Although it was Trump who nominated Powell as Fed Chair in 2017, Powell has been the object of Trump’s public derision. This is a partial list of what the President has said to and about Powell since the Inauguration.

January 29: “I will demand that interest rates be lowered.”

April 4: “He [Powell] is always ‘late,’ but he could now change his image, and quickly. … CUT INTEREST RATES, JEROME, AND STOP PLAYING POLITICS!”

April 17: “POWELL’S TERMINATION CANNOT COME FAST ENOUGH.

April 18: “I think he’s terrible. … If we had a Fed Chairman that understood what he was doing, interest rates would be coming down, too.”

April 21: “Mr. Too Late, a major loser, lowers interest rates, NOW.

May 8: “‘Too Late’ Jerome Powell is a FOOL, who doesn’t have a clue.

June 4: “‘Too Late’ Powell must now LOWER THE RATE. He is unbelievable!!!”

June 12: “‘Too Late’ at the Fed is a disaster! Go for a full point, Rocket Fuel!”

June 18: “So we have a stupid person. … He just refuses to lower rates … he’s costing the country a fortune.”

June 19: “He is truly one of the dumbest, and most destructive, people in Government. We should be 2.5 Points lower, and save $BILLIONS.”

June 20: “He is a numbskull, dumb guy, and an obvious Trump Hater. … We should be at 1% or 2%.”

June 27: “He’s done a lousy job. … I think we should be paying 1% right now.”

Can the President fire Powell? Although the Supreme Court in May of this year gave Trump the latitude to fire the boards of independent government agencies like the National Labor Relations Board, fortunately, the Court specifically “carved out” similar powers over the Federal Reserve Board of Governors.

Trump is therefore setting his sights on naming a loyalist as the next Fed Chair to do his bidding starting next May. He can choose one of the current Fed Governors or, in January, appoint a loyalist to fill the opening brought about by the expiration of Fed Governor Adriana Kugler’s term, and then select that Governor to become Chairman in May.

In his first term, Trump appointed Christopher Waller and Michelle Bowman as Governors. Coincident with Trump’s skewering of Powell, both have suspiciously this past week metamorphosed from policy hawks (inflation fighters) to policy “doves” (prioritizing unemployment at the expense of higher inflation).

This is what Waller said on June 20:

“I’m all in favor of saying maybe we should start thinking about cutting the policy rate at the next meeting, because we don’t want to wait till the job market tanks,”

This is what Bowman said on June 23:

“Should inflation pressures remain contained, I would support lowering the policy rate as soon as our next meeting in order to bring it closer to its neutral setting and to sustain a healthy labor market.”

Bowman, by the way, was promoted by Trump from Governor to Vice-Chair for Supervision in March. Funny, that.

The table is set: Trump can choose from the outside or the inside, and get what he wants - lower interest rates.

Financial Repression

With Trump’s control of Congress, the next Fed Chairman will be more of a “dove” than a “hawk.” Perhaps Trump’s attacks on Powell and demands for lower Fed Funds rates are just his usual bluster. Perhaps, the acronym “TACO,” - “Trump Always Chickens Out,” invented for the President because he retreated from the draconian tariffs he announced in April, will prevail. Perhaps Trump will allow the Fed to pursue its dual mandate of maximum employment and price stability.

But the market will not know for certain for almost another year, but it has to contend with the Trumpian velocity of the twists and turns of this plot.

Remember that the Fed sets overnight interest rates, but the market determines long-term rates. Longer-term rates are more important to the economy than short-term rates. The ten-year Treasury rate is the benchmark for corporate funding and for consumer loans, including mortgages.

On Friday, this is what Trump said at his press conference:

“I’ve instructed my people not to do any debt beyond nine months or so. Get this guy [Powell] out”! And whoever is in there [Trump’s pick for next Fed Chairman] will lower rates…”

And he followed up with these gems:

“Interest rates are just an accounting entry.”

“He can move rates with a pen and we pay less interest. “

“We’re the best economy in the world, we should pay lower interest than everyone.”

Watch a three-minute video of Trump attacking Powell here.

And as I write this on Sunday, in a Fox interview, Trump gets even more specific:

Trump does not yet control the Fed, but he does control the US Treasury. And it is the US Treasury that can unilaterally decide to stop issuing longer-term debt. Trump is thinking: if he can effectively force the next Fed Chairman to radically lower overnight rates from 4.25% to 1% next May, then why should the United States pay 4.25% today to borrow for 10 years?

Has he instructed the US Treasury Secretary Scott Bessent to alter the maturity profile of new Treasury debt issuance? Could the Treasury suspend $3.3 trillion of scheduled issuance of longer-term government debt in favor of short-term government bills? (source Andy Constan, Damped Spring.)

If the Treasury stops issuing long-term debt, long-term interest rates will collapse. Investors would no longer have a say in determining the price of longer-term money. This is called “financial repression,” and the one definitive market result is that the US dollar would be toast.

Why would investors finance the US deficit at rates no longer set by the market? They would rush to sell dollars and buy Euros, Yen, other foreign currencies, and of course, gold.

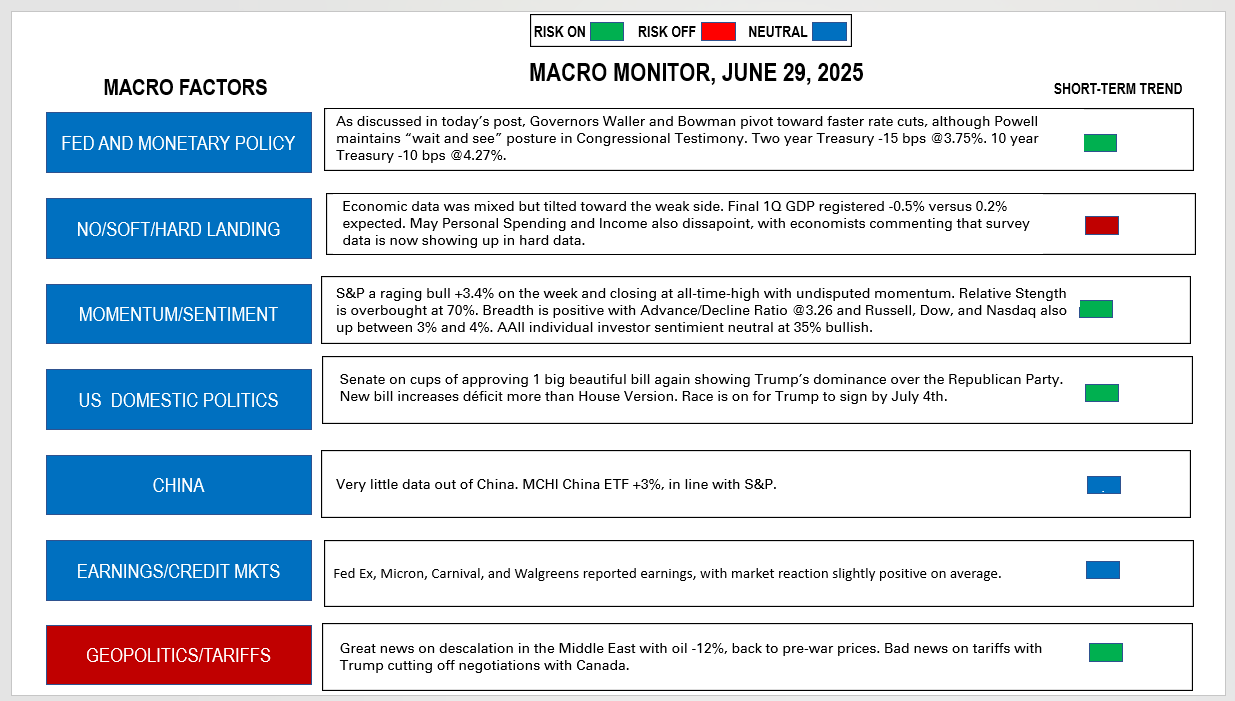

Once again, we are witnessing politics becoming economics. Last week, the “yield curve” steepened: 2-year Treasury rates fell 15 basis points and 10-year notes 10 basis points. This is exactly what to expect when the Independence of the Central Bank is at risk.

Lower long-term interest rates are the desirable consequence of low inflation, inflation expectations, and fiscal responsibility. Trump’s one big beautiful bill offers none of that, while his threat to the Fed’s independence risks higher inflation and inflation expectations.

His interest in manipulating longer-term rates by restricting the supply side of the Treasury market and repressing the market’s equilibrium level for rates could potentially cause a market melt-up. Repressed short and long-term interest rates would make investors search for higher yields, first swapping out of lower-yielding treasuries into higher-risk corporate debt and then higher-risk equities.

This would come at the expense of the US$, which would become the escape valve for investors to flee financial repression. Lower rates would spark higher inflation. Higher inflation and a lower dollar reduce aggregate American wealth.

Messing with the independence of the Fed and the US Treasury may make America Poor Again.

But enough of this dour talk! The market is not taking Trump seriously, at least not yet.

Enjoy that one big, beautiful American Holiday and celebrate our Independence on the 4th of July!

This Week’s Macro Monitor

The Monitor is flashing green - “risk-on” - as markets gain momentum, rallying based on a lower oil price and the dovish pivot by Fed Governors Bowman and Waller.