There can be no doubt that the US economy is chugging along at a healthy pace and that there is no convincing sign that a slowdown is imminent.

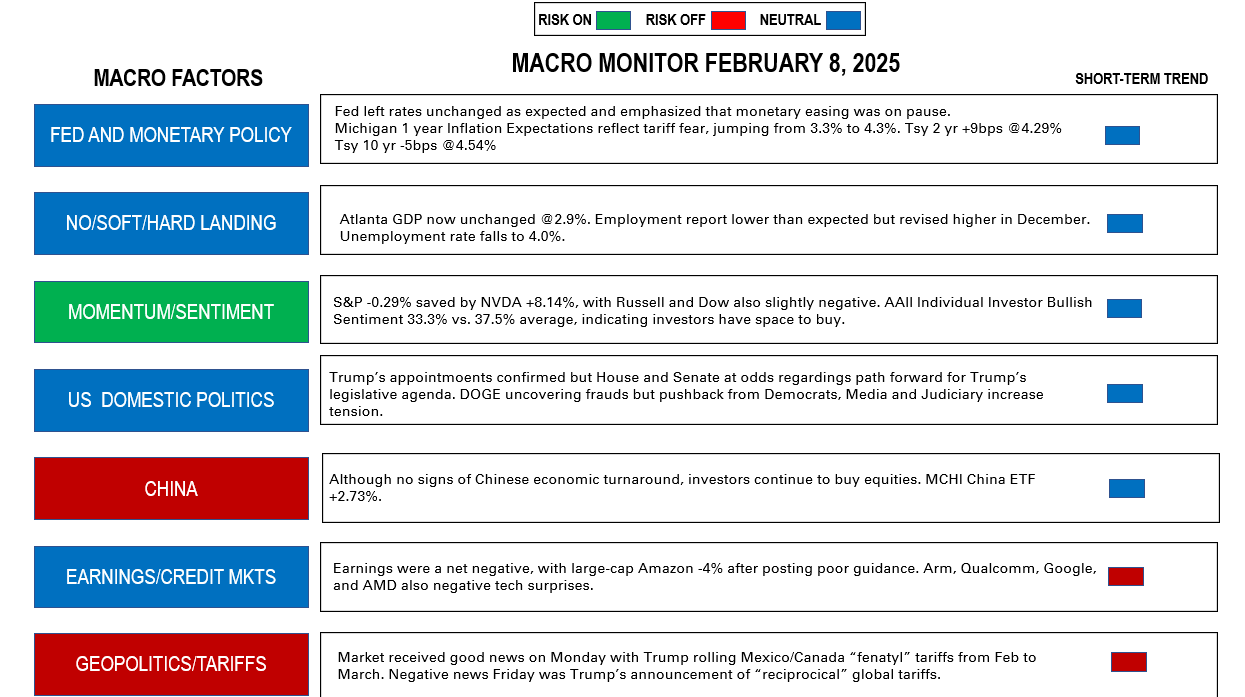

The Atlanta Fed's “shadow” weekly GDP estimate, GDP NOW, was unchanged this week and is humming along at 2.90%. On Friday, the Bureau of Labor Statistics released the January employment report. Total non-farm payrolls expanded by 143,000 jobs last month, below the 175,000 expectation, but the BLS revised November and December up by 100,000 jobs. The Household Survey component of the report showed that the unemployment rate ticked down to a very healthy 4.0%.

The largest economic surprise though was contained in the important but lesser-watched Michigan Consumer Sentiment Survey. Although the sample size is only 500 households, the survey moves the market occasionally. In the survey released Friday, one-year inflation expectations jumped from 3.3% to 4.3%. Considering that the two-week survey period included the week when Trump threatened to levy 25% tariffs on Mexico and Canada, the jump is almost definitely a reaction to the tough tariff talk. Tariffs are, at least in the near term, inflationary.

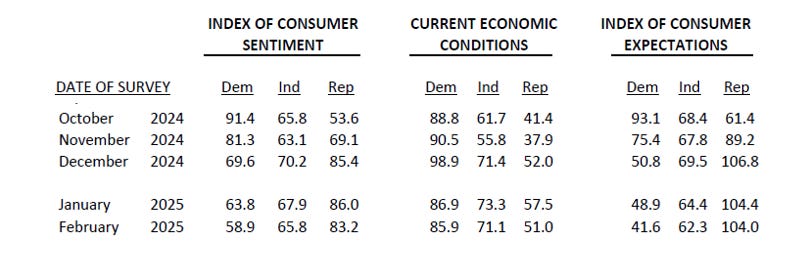

There might be something else going on under the hood as well. Democrats and Republicans don’t see the economic outlook in the same way. Just look, for example, at how Trump’s election victory transformed a lukewarm 53.6 index reading for Republican Consumer Sentiment in October of last year to 83.2 today! Democrats had Great Expectations in October when their Expectations Index registered 93.1. Today, the Dems are in the dumps, with the same index down to 41.6 in February!

Not only are tariffs in the air, but Elon Musk and his DOGE wrecking ballers are too.

Far be it from me to opine judiciously whether Musk’s means justify the ends. That, like the Michigan Consumer Sentiment survey, depends on whether you are a Republican or a Democrat. In case you think it is relevant, I am an Independent, although my Republican friends would swear I am a Dem and my Democrat friends are convinced I am a Trumpista. I hope this shows you that my market and economic analyses are free of political bias.

My interest is to test whether Treasury Secretary Scott Bessent can be taken seriously when he talks about cutting the deficit and focusing on lowering the interest rate of the 10-year Treasury note, which is currently yielding 4.54%.

In my November 25th post, I wrote about Bessent’s market-friendly bona fides. Last week, in an interview with Bloomberg, Bessent took the pressure off the Fed to lower interest rates. Instead, he relayed what is the sound of music to a bondholder - that he and President Trump are looking to implement policies that will sustain long-term economic growth without inflation, through a mix of lower energy prices and reduced government spending, by targetting long-term Treasury interest rates.

“What are focused on is lowering rates. We are less focused on the specifics of rate cuts, but how to get the whole curve down. I mentioned the 10-year (Treasury). I believe it is the most important price to focus on - mortgages long-term capital formation…”

In my January 27th post, “All you Can Eat,” I discussed the 5-D geopolitical chess match that might result in lower oil prices. In that same post, I pooh-poohed the notion that Trump, Bessent, and Musk could make any meaningful cuts to government spending.

I want to auto-question myself about that today.

First, let’s acknowledge that however bombastic Musk’s actions to reduce the government workforce through voluntary and involuntary lay-off and firings and temporary freezes in government outlays, those efforts will not put a meaningful dent in spending by themselves. The layoffs though could put a meaningful dent in the next few months’ employment reports, something to remember as we consider the probable trajectory of long-term interest rates.

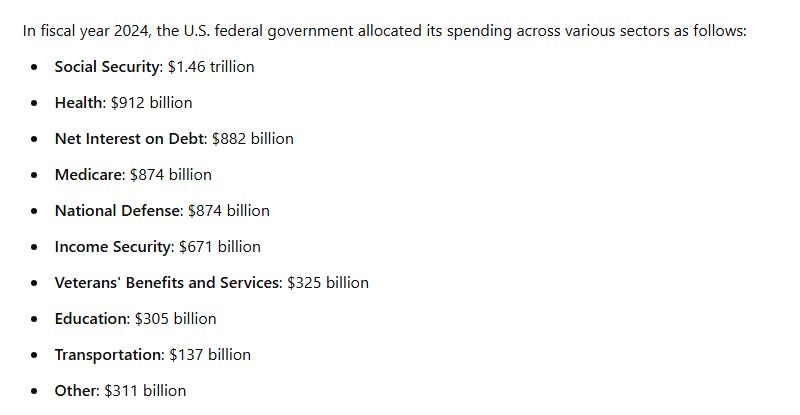

Musk may be able to shave a couple of hundred billion dollars but considering that total annual federal spending is $6.7 TRILLION fixed-income investors will not be lining up to buy more longer-date bonds based on such paltry savings.

Take a look at where the meat in Federal outlays lies:

The real spending cuts must come from Congress and with the current Continuing Budget Resolution set to expire on March 14th, Congress is about to kick off a battle that will be decisive not only for Trump’s presidency but also for interest rates and the financial markets generally.

In one corner, the Challenger, led by the Freedom Caucus in the House, will only vote in favor of extending the Trump tax cuts unless broad, offsetting spending cuts are included in the legislation.

In the other corner, the defending Champion, led by the Establishment (which includes both Democrats and moderate Republicans), will oppose any spending cuts, especially any that might affect Social entitlement programs. Even Trump has vowed not to touch Social Security, Veterans’ benefits, and Medicare.

What about cutting defense? What about other entitlements? Medicaid alone spends almost $875 billion annually, with about two-thirds of the federal government funding it. Food Stamps (SNAP) cost $112 billion.

We have seen that government spending totaled $6.7 trillion in 2024. With revenues of $4.9 trillion, that makes the deficit $2.7 trillion.

On the revenue side, Trump is hell-bent on exempting taxes on tips, on social security payouts, allowing income tax exemptions for car loans and a larger exemption for state and local taxes (the “SALT” exemption). Conceivably, he could use tariffs to make up for some of this lost revenue.

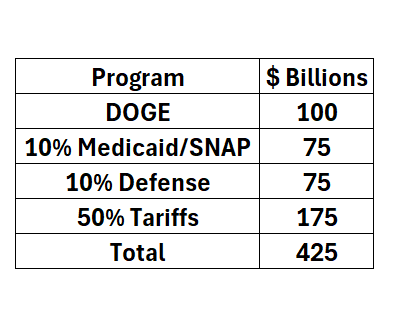

A quick calculation for a scenario where 25% tariffs are levied on all imports from Canada and Mexico along with a 10% tariff on China and Europe would bring in $350 billion annually.

Let’s make these assumptions about how much deficit reduction might be possible:

$425 billion a year would be a 15% percent decrease in the deficit and would sufficient get bond investors’ attention and bring down the yield of the ten-year treasury.

The economics therefore have been political.

Let’s now turn to the difficulties facing the Administration in making this happen:

The Senate wants to divide the legislative attack into two parts - the first including defense, energy and immigration to be approved in the spring, followed by a second tax and spending bill to be debated over the summer.

The House, on the other hand, wants to pursue “one beautiful bill,” in which all of Trump’s proposals are to be voted on together.

This week, expect Trump to decide whether to pursue the one-bill or two-bill solution. Expect him also to attempt to keep the thirty or so members of the Freedom Caucus in line. Whether they hold out for more spending cuts than Trump is willing to offer could determine how the markets will trade for the rest of the year.

As we speak, thousands of federal government employees and employees of entities funded by it are filing for unemployment claims. Half of the country is reining in spending and investment because it fears tariffs. In Congress, spending cuts will be considered.

These are all positives for lower long-term interest rates. Investors willl see that the “direction of travel” is constructive But the cost of lowering the deficit means lower growth and pain may lie ahead for equity investors.

This week’s Monitor shows a slight risk-off, which indicates that this uncertainty may weigh on the S&P as we head into the legislative showdown.

Disclaimer: The content of this post reflects only the views of the author and not necessarily those of Armor Capital.