The British musician Elvis Costello exploded into the pop music scene in the 1970s, mixing his Punk and New Wave with the more entrenched and traditional genres of Folk and Classic rock.

Costello has released over thirty albums, has been inducted into the Rock and Roll Hall of Fame, and has won two Grammys. His song “(What's So Funny ‘Bout) Peace, Love, and Understanding” is the inspiration for today’s post. The journalist Mark Halperin uses the title of the song as the guiding principle for the 2WAY Morning Meeting, one of the best political podcasts and platforms around.

As I walk through this wicked world

Searchin' for light in the darkness of insanity

I ask myself, "Is all hope lost?

Is there only pain and hatred and misery?"

And each time I feel like this inside

There's one thing I wanna know

What's so funny 'bout peace, love and understanding?

PEACE

Friday’s Trump-Putin summit was, to be honest, a big “nothing burger.” Immediately after their vague and almost icy joint news “conference” (where no one conferred), Trump gave an interview to Sean Hannity on Fox News that I eagerly watched, hungry for details on the three-hour meeting that might historically bring peace to Ukraine.

Trump provided almost no substance, but did gloat in Putin’s assertion that the war would have never happened if Trump had been elected President in 2020. In a case of classic confirmation bias, Trump took Putin at his word (!) and used the interview to vent against Joe Biden, who had masterminded the “Russia Hoax” and stolen the election.

On Sunday afternoon, there is scattered hope that a framework for dialogue is emerging. That framework would require Russia to accept NATO providing a security guarantee to Ukraine, while Ukraine would have to cede part or all of the territory that Russia has occupied.

Tomorrow, the Europeans are coming to town. These are the leaders who will visit Trump at the White House to continue deliberations on a possible peace framework.

That means a room full of people, and I can’t imagine what the outcome might be.

I can remember, though, an analogous geopolitical event that did roil markets. It happened in 1991.

I was a market-maker for Treasuries and Mortgage-backed Securities in Tokyo for the now merged-into-UBS investment bank, PaineWebber. The Reagan Administration was frantically trying to broker a peace deal between Iraq and Kuwait. Saddam Hussein had occupied Kuwait, and Secretary of State James Baker was holed up in a high-level meeting with his Iraqi counterpart.

Hopes were high that a peace deal was imminent, but when Baker emerged from the meeting, the first word out of his mouth was “Regrettably.” The market didn’t wait to hear the rest of the sentence. Oil soared and stocks plunged. Some highlights from the Washington Post the next day:

|

It is worth reading the complete article here.

The level of market optimism about tomorrow’s meeting is nowhere near what it was before the Baker meeting. The price of oil has fallen 8% this month, perhaps indicating some possibility of a ceasefire or even a general peace agreement. It is kissing $60 to the downside, a price that will find speculative demand.

For now, though, both sides haven’t yet agreed on whether the objective is a cease-fire or a sweeping peace agreement. We can be sure that Trump, Rubio, and Bessent - all the President’s Men - will put a positive spin on the outcome, one that markets are likely to ignore. The markets will be looking to hear what the first word out of Zelensky’s mouth is. “Regrettably” would be regrettable; “Incredibly” would be incredible.

LOVE

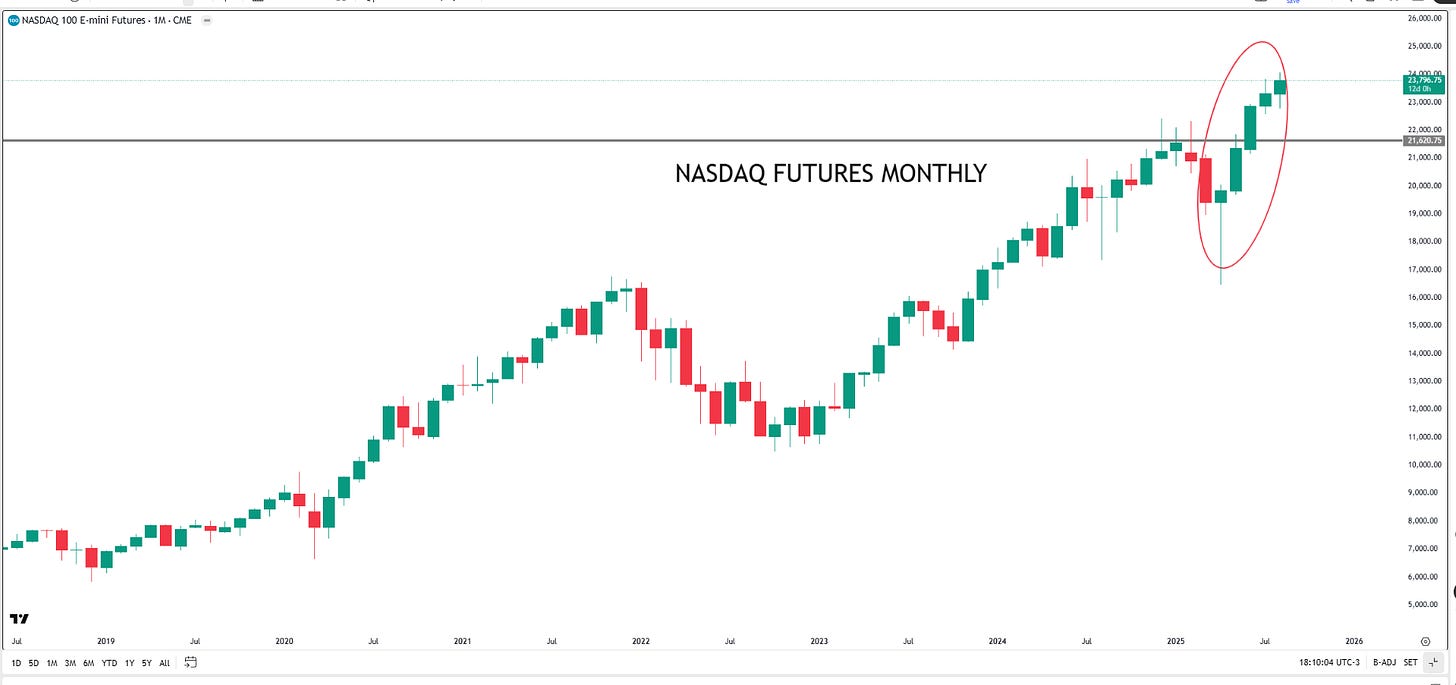

A look at the charts of the major indices below tells the story of how investors have been in love with equity markets since Trump backed off on tariffs in mid-April. Remember, each “candle” represents a month of price action. The S&P and Nasdaq made new all-time highs last week, the Dow is close to making its own, and the Russell, the laggard, is below its post-election sugar high, but has risen for four consecutive months. There is a lot of Love in the Markets.

What has fueled the rally?

In a word, AI.

Here is the monthly chart of Nvidia, the chipmaker that feeds the AI world. NVIDIA makes up 8% of the S&P and 14% of the Nasdaq.

UNDERSTANDING

To understand what is going on, let’s look to the Oval Office and the Ovals in the charts.

The base case for Monday’s meeting is that the markets will be faced with divergent narratives emanating from the Oval Office: Trump pressuring Ukraine to cede land, Zelensky refusing, and the European crowd crossing their fingers that Trump doesn’t reprimand Zelensky publicly and award a chunk of Ukraine to Putin for free. Progress isn’t made, but a new round of talks is scheduled. Markets don’t move much.

The bull case would be Trump and the European leaders transmitting a harmonious message. That would increase pressure on Putin to ease some of his conditions for a peace pact. Further sanctions might be avoided if Putin plays ball. Equities and the dollar would likely rally, and gold and oil would fall.

The bear case would be a breakdown in the talks, with Trump refusing to fund Ukraine out of anger and slapping Russia with more sanctions. In that case, stocks and the dollar would suffer, and gold and oil would rally.

The Ovals in the charts indicate that markets are “over-extended,” to use a favorite redundancy loved by traders. In addition to the possibility that the peace talks fail, the markets face two hurdles that could upend the monster rally.

First, on Friday, Fed Chairman Jerome Powell will deliver the keynote address at the Central Bankers’ Symposium in Jackson Hole, Wyoming. Undoubtedly, he will reiterate the Fed’s independence, which has been under attack by President Trump and many of the President’s Men. The Fed is at a key moment in the monetary policy cycle, and markets have priced in a better than 50% probability that the Fed cuts rates in September, after having left them unchanged since November of last year. Were Chairman Powell to splash cold water on a September rate cut, that would derail equities.

The second hurdle will be Nvidia's quarterly earnings report to be released next week, on Wednesday, August 27th (yes, August is almost over, summer is almost over, and 2025 is almost over). I have no edge in forecasting whether their earnings and other metrics come in better or worse than expected. But I do believe the market is pricing in good news. The outcome is asymmetric: A negative surprise would impact the price downward more than a positive one. Next week, we will delve into the bear for stocks more robustly.

Have we answered Elvis Costello’s question?

What’s so funny about Peace, Love, and Understanding?

My best guess is that on a societal level, we haven’t and we won’t. Achieving all three for a sustained period seems distant in 2025. There is more geopolitical and political acrimony than harmony.

The good news is that on a personal level, peace, love, and understanding might be possible. Writing the wolf of wall street is my attempt to bring peace, love, and understanding to myself and you, dear Reader.

What’s so funny ‘bout that?

Here is “Peace, Love, and Understanding.” I hope you can give it a listen.

The Macro Monitor

The Monitor got it right last week, foreshadowing a risk-on environment. The positive signal is repeated for this week, based on a resilient economy and market momentum.